Figure 1: My new insane medical insurance premiums for the minimum available “Bronze” program, with a $6500 deductible.

My family’s monthly health insurance premium, which had already more than doubled in the last few years to $674 per month, was going up a further 44% for the coming year. For no good reason, other than perhaps the the current government’s attempts to kill off the Affordable Care Act. (By cutting various parts of the structure, the insurance market becomes less stable and predictable, and thus more expensive).

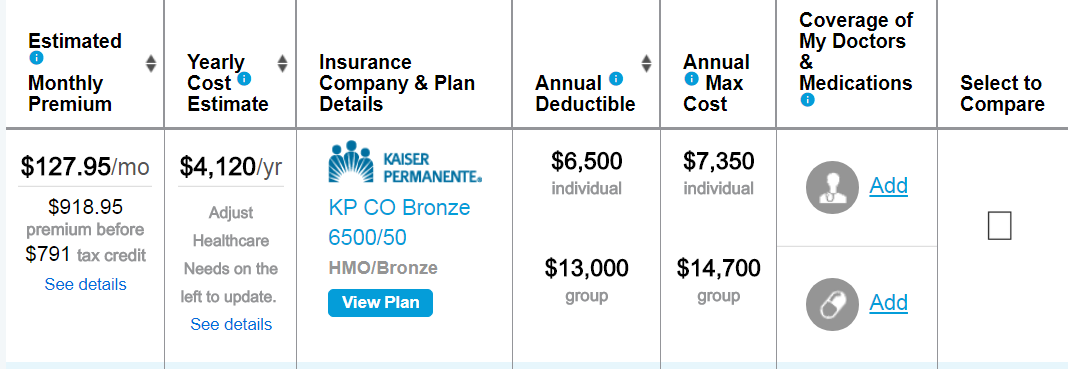

Now, before we go any further, I have to note that this is a situation that only affects high income earners. If we were really retired on a $30,000 passive income as we were for some of the decade before this blog started making significant money, our family’s monthly cost would be more like $128, due to tax credits and the Children’s Health Plus plan.:

Figure 2: Net insurance cost for a $30k per year family of three.

But in my email, I just saw the thousand bucks. And if you know how know how I feel about rules, unnecessary costs, and insurance in general, you can probably guess what my initial gut reaction was:

But, since I’m not sixteen years old anymore, I was eventually able to get past this first stage of the analysis and think about an actual course of action.

After all, all the power and freedom in the world is of no use at all, if you choose to wallow in your anger rather than taking steps to create the life you want. So I thought about why I was so angry. It boiled down to this:

The premiums are not an accurate representation of my risk.

The value of medical insurance is pretty easy to estimate: the National Institute of Health calculates that the average person consumes about $449,000* in health care spending over an 80-year lifetime, or $5600 per year. This is less than my plan’s deductible alone, which eliminates the value of insurance right off the bat. My plan really only covers catastrophically expensive events, which means it is unlikely that I will ever use it.

Plus, most medical spending is loaded towards the last decades of life, where the Medicare program already picks up the bulk of the costs. And, we are healthier than average – aside from one baby delivery about twelve years ago, none of us have ever actually benefited from health insurance in over nineteen years in the country.

When you add up these factors, it is obvious that the insurance is a bad deal. When presented with overpriced insurance, I always just choose not buy it, which is also called “self-insuring”. But whenever I talk about self-insuring for medical expenses, everyone asks the same question:

“But what if you do get hit by a falling piano and have to spend months in the Intensive Care Unit?”

The answer is that I guess I’d receive some large medical bills!

I’m not denying that an expensive treatment absolutely can never happen to me. I’m just putting an estimate and a limit on how much I am willing to pay for insurance on it.

Remember, health insurance not really health insurance. It’s just “large medical bill insurance” – a shaky precaution against having to pay for expensive procedures, so you can keep your investments instead of using them to pay the bills, perhaps eventually becoming poor enough that you are covered by public health insurance (Medicaid). A better name for it might be wealth insurance.

We have been trained to think that going without medical bill insurance is very risky. But that’s just because the subject appears frequently in the news. If it weren’t such a hot topic these days, the average person without a chronic illness would rarely think about it.

After all, by comparison, what precautions have you taken against being hit by a meteor? There could be one streaking towards you right now. It could kill you, or your children, or it could leave you with lifetime of chronic care costs. Are you telling me you don’t have separate meteor insurance? Why not?

In 2013 a 60-foot chunk of rock came from space and hit Russia with the force of 30 Hiroshimas. The human race escaped with just 1500 injuries, but only because the rock came in at a shallow angle and landed in a very remote area.

If space rocks are too far-fetched, how about motor vehicles? If you choose to drive a car, you are willingly throwing yourself into a far riskier situation than simply self-insuring for medical bills. Even more dangerous, statistically: being inactive and/overweight, a boat in which over 66% of us sail every day.

The point is that while huge, uncovered medical bills are inconvenient, they are rare. Therefore, my willingness to pay for insurance against them must have a limit. I’d definitely pay $50 per month for it, but should I be willing to pay $1000?

What about $2000? $4000? $12,000 or $1 million per month? I think that everyone would hit their “Fuck That” point somewhere in there.

And remember, this problem of expensive medical procedures is unique to the US. You can take your dollars almost anywhere else in the world and pay out-of-pocket to get the same (or better) quality care for a fraction of the cost. At some point, a rational person has to be willing to stop overpaying for this inefficient system.

After doing the math, I decided that my limit is definitely less than $1000, which means I should at least consider other options. So I looked into some of them:

- Full Self Insurance

- 2.9 Months per year of Self Insurance (to avoid IRS penalty)

- Medical Tourism

- joining a “Healthshare Ministry” like Libertyshare

- expat insurance like Cigna

- Artificial poverty (reducing my income to a level where we’d qualify for subsidies)

Self Insuring is the easiest choice: you just don’t renew your insurance and start banking that sweet surplus right away. There is a tax penalty for that: $695 per adult, $347 per child, or 2.5 percent of your adjusted gross income – whichever is greater. Thus, a family with $100,000 of income would pay a $2500 fee. With my new premium at $11,500 per year, the penalty would still be cheaper all the way up to $461,000 in income. Plus, there are a surprising number of qualifying exemptions, including a death in the family within the last three years, a category which unfortunately includes me.

A 90 Day Insurance Vacation is the lightweight version of self-insurance. The penalty only applies if you were uninsured for three months or more. So if you set your new insurance to take effect on, say, February 27th, you cut your premiums by about 25% in exchange for the reduced risk protection. Just be sure to postpone your Wingsuit Jumping vacation until at least March.

Medical Tourism is an important thing that every US resident should be aware of. After all, we live in the country with the most overpriced medical procedures in the world – why should we insist on doing 100% of our shopping here? This would be like insisting you buy only US-produced goods and services: no electronics, no shoes, no Amazon and no blueberries in winter. We should all read a book or two on the subject to understand just how easy it is, to free ourselves from the US-centric assumption that doctors are shockingly expensive.

Health Sharing Ministries like Liberty HealthShare looked like the most promising loophole. Due to the strong influence of organized religion in the US, if you can join one of these, you are exempt from the tax penalty. The downside is the same as the upside: these ministries are exempt from ACA rules, which means they can drop you for having a pre-existing condition. And they also want you to affirm their value system, which can range from agreeable stuff like “taking care of your health” to excluding coverage for things that violate religious taboos like abortion or attempted suicide.

Expat Insurance sounded promising when I first heard about it from some fellow Canadian early retirees who write the blog Millennial Revolution. Companies like Cigna will cover you for worldwide medical costs for a fraction of what we pay here in the US. But the hitch is it only applies if you are truly on the road and don’t actually reside here. So it’s not an option for now. But in the long run when I retire to an oceanfront compound (or commune?) in Costa Rica, yes.

Reduced Income is the last and least feasible option on the list for me right now, but it’s genuine and not even artificial in the case of the typical early retiree.

Suppose you are retired with, say, a mortgage-free home and $800,000 in index funds, and living on a plentiful $30,000 per year. Your income tax return will show only about $18,000 in dividends, some of them even tax-exempt. On top of that, you’ll sell just a few shares and pay taxes only on the capital gains. This taxable income in the mid-20s will keep you in a very low tax and health insurance bracket.

So What Path Did the Mustache Family Take?

I brought all this stuff up to Mrs. MM – the other, less morally-outraged, leader of our household. Our conversation brought up a few things:

- Although a $12k insurance bill is insane, we would not even notice a $12,000 difference in income taxes if the brackets were to change. We currently have a high income, but this has not caused us to increase our family spending at all. This is because of the magic of living below your means: once you have enough money, the surplus is just that: a big, fat, awesome bonus. Since I want this enormous surplus to go back to society over my lifetime, why should I be upset about some of it paying for other peoples’ health insurance right now?

- But, I countered, this doesn’t apply to everyone. The typical MMM reader earns enough money to be hit by these higher premiums, and many are raising families and running small businesses, thus purchasing health insurance on the open market. At the same time, they are trying to save as much money as possible to reach financial independence while they are still young enough to enjoy it. Burning $12,000 per year on mostly-useless insurance can wipe out 25% or more of the amount you could otherwise save for retirement.

- Given this, the Healthshare ministry was one of the better compromises. However, she felt that pretending to agree with a religion (especially if it’s one that actively oppose some things we value like same-sex couple equality and women’s reproductive rights) wasn’t worth it for us.

- In my own hypothetical pre-retirement situation (a self-employed couple making $200,000) I would probably go for full self-insurance, simply paying the tax penalty whenever necessary and using medical tourism for any expensive procedures.

- But also remember that if you’re a high-income business owner, your business can pay for your health insurance with pre-tax money. This cuts your net cost after taxes by 30-40%, making it a subsidized program after all.

So in the end, we’re just letting the policy auto-renew for now, using that last bullet point as a consolation prize. And these premiums will probably remain outrageous, unless we fix the underlying problem in the US: it’s not the insurance, it’s how much money we waste on medical care. If the Medical system could grow a Money Mustache**, I am certain we could cut our costs down by at least 75%, just as the average consumer can cut their costs by a similar portion just by learning to life a joyful and efficient life.

Footnotes:

* I adjusted the NIH paper’s 2000 numbers to 2017 dollars.

** Ideas for making US healthcare less expensive – please critique and add your own in the comments!

- Eliminate the 75% of healthcare spending we currently waste on self-imposed lifestyle diseases: eliminate subsidized urban car infrastructure in favor of muscle-powered transportation. Treat soda and products with added sugar in the same way we currently treat liquor. Treat health and fitness (rather than medical treatment) like a human right, instead of a vanity accessory just for rich mountain-dwellers and celebrities.

- Make health care purchasing look more like Wal-Mart and Amazon, and less like the DMV. Every standard procedure needs to be listed on a menu with a price, and those need to be on the front door so they are subject to competition. By huge national or even international companies and co-ops.

- Drastically increase the supply of doctors, and make the job more enjoyable: Cut mandatory work hours for residents from 80 to 40 per week. Modernize the medical school curriculum to eliminate pointless memorization, reflect current technology and reduce the cost of the degree. Open the borders to qualified doctors from other countries. Allow telemedicine – let doctors in other countries certify easily for US diagnostics and prescriptions.

- Elevate nurses to do all the stuff they already do, but in their own clinics without working for a doctor and paying the money up the chains.

- Start using search engines and artificial intelligence for diagnosis, rather than flawed and expensive humans.

- Open state and national boundaries for insurance and hospital services with only the required regulations for safety as we do with other imports.

- Eliminate the right for anybody to sue for medical malpractice, or indeed for pretty much anybody to sue anybody else for anything. Let’s make our professional reputation and our actions public and then just suck it up like adults, reinvesting the enormous proceeds currently wasted on litigation.

- Figure out if we can make single-payer health insurance can work for us as it does for most countries. There are many benefits, but the biggest is probably just eliminating all the mental energy we each waste on thinking about this mundane topic. As an analogy, imagine if every citizen had to hire their own police force for personal security – just think of how much energy and fear would be wasted on this topic, which we barely have to think about right now. As it turns out, it works the same way with health insurance.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment