Everyone, I have a confession to make…

…I’ve been WRONG about ultra-frugality this whole time.

That’s right. It turns out that ultra-frugal living tips — ones that’ll save you literally DOZENS of dollars every year — are the best solutions to your financial woes.

Who do I have to thank for opening my eyes?

Why, websites with listicles for the “XX best frugal living tips” of course! Without their amazing, not-at-all-scream-inducingly awful insights on human psychology and personal finance, I wouldn’t have realized that my life of eating avocado toast, drinking lattes, and doing the things that I truly love are actually holding me back from a Rich Life.

I KNEEL AT THE ALTAR OF ULTRA-FRUGALITY.

Whoa, sorry about that. There must be a gas leak in my apartment. What I meant to say was ULTRA-FRUGAL LIVING TIPS ARE COMPLETE BS. If you think that clipping coupons and listening to frugal living “experts” will get you closer to living a Rich Life than focusing on the Big Wins, you’ve got another thing coming.

I’m sick of seeing terrible frugal living “advice” out there. That’s why I want to put the heat on some of the absolute dumbest advice I’ve ever seen in my life.

These are actual, real tips I’ve found on a certain website millions of people go to for personal finance help every month.

Sit down, students. Class is in session.

Bad frugal living tip #1: “Make DIY things and stop paying for stuff!!”

LOL you know what’s an easy way to have guests NEVER want to go to your house again? By being so damn frugal that you make ugly chairs and tables that collapse at the slightest breeze instead of buying them.

Hell, unless you actually like DIY (which is fine!), nobody should turn to it as a way to save money on your day-to-day. Why? We should use our time to do things we love. If you’re making things out of obligation to your bank balance, it’s time to “DIY” yourself a new bank balance. The problem isn’t that you don’t have a chair. It’s that you don’t have the extra money to buy the one you need.

The reason people turn to crappy advice like this is purely psychological. Our culture has convinced us that we shouldn’t spend money on simple luxuries and so we turn to advice like “Just make your own clothes and cut your own hair! It’s cheaper!!!”

My thoughts on that:

Instead, I have a way that’ll let you spend your money on exactly what you want every month.

Alternative frugal living tip: Make a conscious spending plan and spend on the things you love

Conscious spending is the be all and end all solution to indiscriminately cutting out things like buying lattes to make your own coffee at home because you don’t know how much you can actually spend each month.

This system lets you know how much money is in your bank account to spend without you worrying about having to make rent and pay the bills, because it’s already been done for you.

How? Through automated finances. This is the system where your paycheck automatically divvies up and transfers to where it needs to go as soon as you receive it.

Here’s a 12-minute video of me explaining exactly how to do it.

Bad frugal living tip #2: “Get multiple credit cards for their bonuses!!”

If you like watching your credit score fall faster than a college freshman after his first keg stand, I have some frugality advice you’ll love: Open up a bunch of credit cards for their bonuses!!!

It’s free money!!

Right?

No. Not only is opening up multiple credit cards going to negatively impact your credit score, but it’s also such a SMALL win, it’s not even worth it.

Sure, your credit utilization rate will be up — but that, in a way, can actually be a bad thing. Signing up for four different credit cards because of their perks (which exist SOLELY to sucker you into getting the card and running up a huge balance) is giving yourself four more avenues to fall into debt. And if you’re in a position of signing up for cards just so you can squeeze out the cash back perks, candidly, you shouldn’t open new credit cards.

And in an age where the average American household has nearly $17,000 in credit card debt, do you think it’s a good idea to give yourself more opportunities to dive head first into debt? No, I didn’t think so.

Don’t get me wrong. I LOVE certain credit cards because of their perks — but you shouldn’t just sign up for one with the hope that you’ll make quick cash. It should be a long-term effort that happens only after you’ve paid off all of your debt.

Alternative frugal living tip: Get your credit score and improve it

Improving your credit score is potentially worth tens of thousand to you. Seriously. Here’s why:

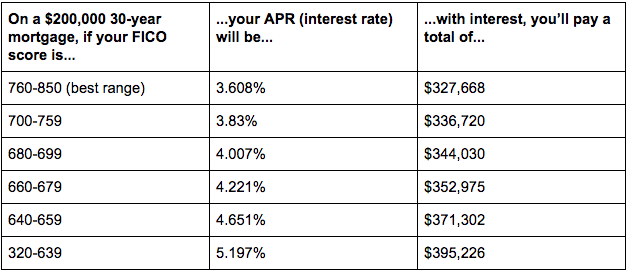

Imagine there are two people: Olivia and Andrew.

Olivia has a few credit cards and makes sure she pays her bills in full and on time. As a result, her credit score is 760, which is awesome.

Meanwhile, Andrew keeps doing dumb stuff like opening up multiple lines of credit because he’s swayed by the bonuses. He often forgets to pay a few of his bills on time, and when he does he only pays the minimum. As a result, he has a credit score of 620, which is abysmal.

Eventually, they both decide to buy a similarly priced house. Who do you think has to pay more for the house in the long run?

Source: MyFico.com. Data calculated in June 2017.

Over 30 years with a mortgage of $200,000, Andrew will end up paying nearly $68,000 more than Olivia in interest — all because his credit score is sub-640.

This is a BIG Win (unlike opening credit cards just for the rewards).

And it’s not just homes. Your credit score impacts purchases on cars, getting apartments, and can even affect whether or not you get a job (47% of employers run credit checks on potential hires).

So don’t be like Andrew. Instead, check out my articles explaining exactly how you can improve your credit score and get out of debt, and put yourself on the path to saving tens of thousands today.

Bad frugal living tip #3: “Take surveys for quick cash!!”

I want everyone to say it with me.

TAKING SURVEYS IS NOT A GOOD WAY TO MAKE MONEY.

Sure, they give you money — but it’s bad money.

I’m talking about making a few dollars for a half hour of your time.

Say a survey pays $10 and it takes 30 minutes to finish it. That’d be $20 an hour you’re making, which is good…right?

NOPE. Especially when you consider the fact that:

- Those surveys come few and far between.

- You could be putting time into finding a stable job you love.

- You could use the same half hour to save hundreds of dollars with just a few phone calls.

And I’m going to show you exactly how those phone calls can help you save right now.

Alternative frugal living tip: Take advantage of hidden income

Hidden income is money that you could be saving right now through simple negotiation tactics (instead of weird scammy “gigs” like taking surveys).

It’s pure 80/20 rule — where 80% of your results come from 20% of your work.

With just a few one-time, 5-minute phone calls, you can save HUNDREDS a month on bills for your:

- Car insurance

- Cell phone plan

- Rent

- Cable

- Credit card

It’s simple too — there are only 3 things you need to do to negotiate with these companies on fees and rates:

- Call them up.

- Tell them, “I’m a great customer, and I’d hate to have to leave because of a simple money issue.”

- Ask, “What can you do for me to lower my rates?”

Of course, you’re going to want to adjust this formula for whatever company you’re calling. Check out my video on negotiating your bills for a great system that’ll help you out.

Along with your bills, you can also be EARNING more money through salary negotiation.

This is actually one of the easiest ways to earn more money. And in many cases, getting a raise only takes a single, 15-minute conversation with your boss.

If you’re interested in learning how to boost your income for life, check out my Ultimate Guide to Salary Negotiation (it’s free). It includes HD videos, word-for-word negotiation scripts, and walks you through each step in the process of getting a raise.

It’s a quick win, and you should absolutely capitalize on it. But if you’re looking for something that takes a bit more time — with a lot more upside — you should consider starting a side hustle.

Which brings me to…

Bad frugal living tip #4: “Sell your hair on eBay for cash!!”

As a hairy guy, this should be great news since I’m probably walking around with a small fortune attached to my body. Unfortunately, though, I don’t want to meet the person who wants to buy my hair.

The type of guy who wants to buy my hair

Don’t get me wrong. I LOVE it when people embrace their inner-entrepreneur — but my issue with selling your hair is that it’s not a long-term solution to your money problems.

If you want to sell your hair because you were cutting it anyway, I still don’t think it’s worth your time and energy to try and sell it. Your time is valuable. Instead of spending it being a human hair farm (that’s my new punk rock band name btw), I’d like to suggest a better way to do it…

Alternative frugal living tip: Sell your skills with a side hustle

From my years of experience running my own business and teaching thousands of people to start their own as well, I’ve found that there’s no best way to work towards your own Rich Life than by starting your own freelance side hustle.

By utilizing the skills and talents at your disposal, you can start freelancing and generating a steady source of income on the side like these students did.

And the best part: You don’t even have to quit the job you already have. By working on your freelance hustle for an hour after work and a few hours on the weekend, you can easily start gaining clients and earning more money this week.

To help you get started, check out my article on how to make extra money on the side. It’ll give you a solid system on how exactly you can get your hustle up and running.

Bad frugal living tip #5: “Sign up for clinical trials for extra income!”

Have you ever wanted a gig in science but didnt want to do the whole “school” thing? You can make money by devoting many hours out of your week to have actual scientists observe and study you!

…or you can save your time and energy and devote yourself to learning skills that’ll actually get you the job you want and earn you cash.

I’m not saying that clinical trials are bad. There is a lot of good that can come from participating in clinical trials. They’re incredibly important when it comes to advancing medicine and scientific research — and if you have a rare disease or abnormality, you can help doctors and researchers better understand how to treat others like you.

However, I want to make one thing clear: CLINICAL TRIALS ARE NOT A CAREER!!

And yet, so many people actively treat things like taking surveys and participating in clinical trials for cash as a way to make “income.”

Instead of trying to make a quick buck by signing up for clinical trials, try this:

Alternative frugal living tip: Sign up for my newsletter

You should always be in a state of curiosity. Ask questions when you don’t understand something and don’t be afraid to seek out more information through books, courses, or schooling. It’s only then that you can hope to truly live your Rich Life.

Your thirst for education should be constant and voracious. I don’t care if you’re reading this in your twenties or your sixties. There’s always something new to learn that you can add to your well of knowledge to draw upon.

That’s why I want to invite you to sign up for my newsletter. Every day, you’ll receive some of the best insights and systems into personal finance and development out there. If you’re sick of all the scammy “tactics” and snake oil salesmen, you can stop worrying.

IWT’s got your back.

The 5 best (and worst) frugal living tips we know is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment