When I woke up last Thursday, I thought my mother was flat broke. I went to bed with the shocking realization that she’s a millionaire.

Long-time readers will recall that my mother has struggled with her health for a number of years. She’d been living on her own, receiving ongoing treatment for schizophrenia, since my father died in 1995. Things gradually got worse until in 2010 we three sons had check her into a psychiatric ward for a couple of weeks so she could receive intensive one-on-one care. She seemed fine after that, but a few months later she experienced a crisis. She drove her car through the back of her garage.

We took Mom to the hospital, but the doctors couldn’t figure out what was wrong with her. When she was discharged, we placed her into a “memory care unit” at a local assisted living place (which I call Happy Acres).

“I’m not sure how we’re going to pay for all of this,” my youngest brother (Tony) said at the time. “Mom only has $20,000 in the bank.”

“We’ll figure it out,” my middle brother (Jeff) said. And we did.

Managing Mom’s Money

Jeff and I gained power of attorney, which has allowed us to manage mom’s accounts and to make decisions for her well-being. Although it hobbled the business, we structured it so that the family box factory channeled some of its profits directly to her care. (Since she owns 60% of the company, this seems perfectly reasonable.)

For the past six-and-a-half years, Mom has enjoyed a pleasant routine at Happy Acres. After a short stay in the memory care unit, she moved into an apartment of her own. I took her to the Humane Society to choose a cat. She loves Bonnie and Bonnie loves her. Mom has a group of friends that she eats lunch with every day. Mom is quiet. She doesn’t say much. But she likes it when we drop by to see her. (To be perfectly honest, my middle brother sees and cares for her more than me and my youngest brother.)

At the end of 2017, Jeff sent me an email. “Mom got a letter from Social Security. She has to start taking payments when she turns 70 in April. I have no idea how to deal with this. Can you handle it?” Can I handle something related to personal finance? You bet!

Last week, I drove down to the box factory to take a look at the paperwork. I opened the envelope containing Mom’s statement of benefits from the Social Security Administration. “It says here that she should get about $2161 per month,” I said.

“Wow!” Jeff said. “That much?” I’m not sure he’s ever looked at his own statement of Social Security benefits before. (Later today, I’ll share how you can check your current statement online.)

“Yes, that much,” I said. “And she’ll probably need to start taking required minimum distributions from her IRA.”

“What are those?” Jeff asked.

“Once you reach a certain age — 70-1/2, I think — you have to start pulling money from your retirement accounts. Here, let’s look it up.” We pulled out her most recent statement from Vanguard.

Mom Is a Millionaire!

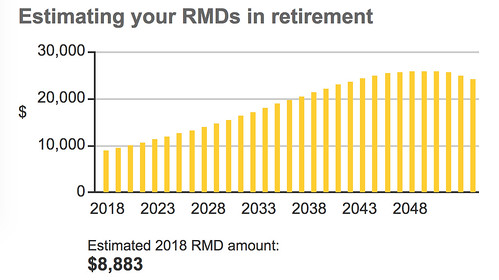

Our research revealed that mom has $243,400.80 in a SEP-IRA (a self-employed IRA). Running the numbers through the Vanguard website revealed she needs to withdraw a minimum of $8883 per year — or about $740 per month.

“It looks like she’ll be receiving roughly $2900 per month in benefits,” I said. “Not bad. That’ll help defray some of her costs. It might actually let us increase her standard of living, too.”

Then something occurred to me.

“Jeff, does the box factory own this land or does Mom own this land?” I asked.

“Mom does,” Jeff said. “Why?”

“Let me look it up on Zillow.” I pulled up the current estimate of the land value for the box factory. Zillow believes those two acres are worth $349,000. Then, for kicks, I pulled up the value of Mom’s house. (She owns a small home on two acres, the home where my father grew up in the 1940s and 1950s.) Zillow estimated the value of that property at $414,225.

“Jeff,” I said. “You’re not going to believe this. Mom isn’t broke. Mom is a millionaire.”

“WHAT?!?” Jeff said.

“I’m serious. When you combine the value of the two properties with the value of her retirement account, she has a net worth of $1,006,625. She’s a millionaire. Plus, she receives rent from the tenants in her house and rent from the box factory. Meanwhile, because she owns 60% of the business, she’s getting a chunk of the profits every month!”

We were shocked. Mom is a millionaire! For years, we’ve believed that she’s broke. Her bank account barely has enough to support her monthly expenses. But all this time, she’s been sitting on a pile of wealth.

Looking to the Future

The sad part, of course, is that Mom isn’t able to enjoy that wealth. She’s not in any condition to travel the world, to enjoy luxury accommodations, to buy fancy clothes. She’s nearly seventy years old and suffering from both physical and mental ailments.

Yes, we can employ that net worth to make sure she receives the best care possible, but she’s not going to be able to have fun the way a seventy-year-old millionaire should have fun.

Mom’s situation also demonstrates why some people do not include home equity when calculating net worth. They understand that money is a portion of their wealth, but it’s also illiquid. It’s wealth that cannot be accessed quickly or easily. So, some people leave it out of their net worth calculations. (My argument is that net worth has a precise definition. I understand the reasons for wanting to leave home equity out of your considerations, but the number you’re calculating is then not net worth by definition.)

In the short term, Jeff and I plan to get Mom’s Social Security benefits and retirement distributions flowing to her bank account. After we see what that cash flow is like for a few months (or a year), we can make more informed decisions about her future. Long term, we’re not sure what should happen. We know for certain that we’ll sit down and have a chat with her to see if there’s anything we can use this wealth for to make her life better.

Mom is a millionaire, after all. She should enjoy her wealth!

The post My mom is a millionaire! appeared first on Get Rich Slowly.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment