Today’s article is from Chad Carson, who writes about real estate investing (and other money matters) at Coach Carson. I’ve always been intrigued by real estate investing but overwhelmed by how much info available. I asked Chad if he’d be willing to write an article that would help me (and other GRS readers) understand the basics of real estate investing. This is the result.

I got started in real estate investing right after college. Because a young adult can basically sleep in a car if he has to (my 1998 Toyota Camry with cloth seats was comfortable), I had little to lose by launching a business. Unfortunately, as a Biology major, I also knew very little about business or real estate. But I did know how to hustle and to learn. That helped.

Slowly, I learned to find good deals and to resell them for a small markup of profit (a.k.a. wholesaling). I also learned to buy, fix, and flip houses for a bigger profit (a.k.a. retailing). After a few years, my business partner and I began keeping some rental properties because we knew that was the path to generating regular, passive income.

While my early business might sound like an exciting HGTV house-flipping show, it’s not for everyone. I experienced radical ups and downs of cash flow, and there were many unpredictable outcomes. I learned a lot being a full-time investor, but there are actually easier ways to get started.

Most investors I know started with a full-time job. They became valuable at their job, earned good money, lived frugally, and started boosting their saving rate. With their extra savings, they began buying rental properties on the side.

I’m not saying you shouldn’t begin as a real estate entrepreneur like I did — you’ll know if you’re called to make that leap — but if you currently have a non-real estate job and you’re saving money, you’re already going down the easiest path.

The next step is to learn how to invest that money profitably and safely. I personally think real estate investing is one of the best ways to do that. I’ll show you why that’s the case in the next section.

Why Real Estate Investing? Because It’s Ideal!

I’ve yet to find a better way to describe the benefits of real estate than this. All you need to remember is the acronym I.D.E.A.L:

- Income. The biggest benefit of real estate is rental income. Even the worst rentals I find produce more income than a portfolio of other assets like stocks or bonds. For example, I often see unleveraged (no debt) returns of 5-10% from rental income. And with reasonable leverage, it’s possible to see these returns jump to 10-15% or higher. The dividend rate of the S&P 500, on the other hand, is only 1.99% as of 1/24/17. And the yield on a broad basket of US bonds as of the same date was only 2.41%.

- Depreciation. Our government requires rental owners to spread out the cost of an asset over multiple years (27.5 years for residential real estate). This produces something called a yearly depreciation expense that can “shelter” or protect your income from taxes and reduce your tax bill. (For more about this, check my article The Incredible Tax Benefits of Real Estate Investing over at Mad Fientist.)

- Equity. If you borrow money to buy a rental property, your tenant basically pays off your mortgage for you with their monthly rent. Trust me: Having somebody else pay your mortgage is a beautiful thing! Like a forced savings account, your equity in the property gets bigger and bigger over time.

- Appreciation. Over the long run, real estate has gone up in value about the same rate as inflation, roughly three to four percent a year. Combined with the three benefits above, appreciation can produce a very solid long-term return. But this passive style of inflation is not the whole story. Active appreciation is even more profitable. You get active appreciation when you force the value higher by doing something to the property, like with a house remodel or changing the zoning.

- Leverage. Debt leverage is readily available to buy real estate. This means your $100,000 of savings can buy five properties at $20,000 down instead of just one property for $100,000. Interest on this debt is deductible, so you also save on your taxes. (While this can be helpful, keep in mind that leverage also magnifies your losses if things go bad.)

These IDEAL benefits are core reasons to invest in real estate. But as a Get Rich Slowly reader, I think you’ll appreciate another core real estate investing benefit: control!

Controlling Your Financial Destiny

I love J.D.’s message here at Get Rich Slowly: You are the boss of you! You can apply this lesson to so many parts of life, but it especially applies to your finances. Real estate investing fits very well with the GRS philosophy. Why? Because real estate gives you much more control than other more traditional investments.

I love J.D.’s message here at Get Rich Slowly: You are the boss of you! You can apply this lesson to so many parts of life, but it especially applies to your finances. Real estate investing fits very well with the GRS philosophy. Why? Because real estate gives you much more control than other more traditional investments.

I’m also a fan of low-cost index fund investing, for example, but do you have an impact on the returns of your stock portfolio? Not really. The 3500+ managers of the companies owned by the VTI total stock market index fund do impact your returns, but not you personally. You simply control when you buy, how much you buy, and when you sell.

But with a rental duplex, for example, your decisions directly affect its profitability (for better or worse!).

- You can buy in certain neighborhoods and ignore others.

- You can negotiate with your bank, with the seller, and with your vendors to get better prices.

- You can choose the property manager and the types of tenants who will ultimately produce the returns for your investment.

If this prospect of control excites you, then keep reading. But if your palms are clammy at the idea of hands-on investments, just focus on a different vehicle. That’s okay. There are options for everyone in this big investing universe!

To make things manageable, we’re going to break things down a little. As a baby, you learned to walk by taking tiny steps. You also fell down a lot, but with a diaper four inches from the ground, what’s the harm?!

Well, you’re no longer a baby. Financially you do have a lot to lose. Your family, your hard-earned savings, your plans for financial independence, and your pride would all suffer if you made bad investments.

I get that. And that’s why we still need to take safe, baby steps. There’ll be plenty of time to run and grow faster once you’re more confident. But in the beginning, just strive to move forward steadily.

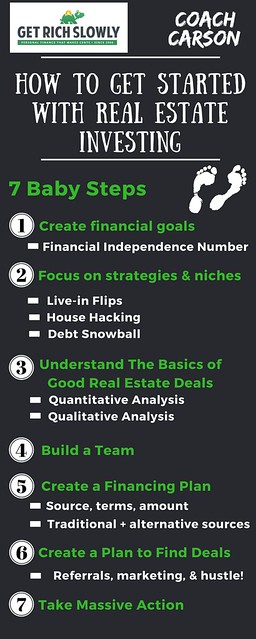

The seven baby steps below provide a simple path to follow. I’ve taken each of these steps personally. You can use them as a blueprint to help you move forward with your own real estate investments.

Step 1: Create Financial Goals

Real estate is simply a financial vehicle. Before you begin to buy real estate, you have to have a clear picture financially where the vehicle will take you.

If you haven’t done it already, read J.D.’s Financial Independence in Plain English. You’ll learn that a solid financial independence goal is to achieve a net worth equal to your current annual expenses multiplied by 25. In other words, if you spend about $50,000 per year, your goal should be to achieve a net worth of around $1,250,000. With this level of wealth, you could likely withdraw 4% of your net worth each year without completely depleting your money.

While these assumptions are typically made for traditional portfolios of stocks and bonds, real estate works much the same. In fact, it’s much simpler.

Let’s say once again you spend about $50,000 per year. And let’s assume you can produce a cash-on-cash return of 6% with your real estate investments. (This return — or better — is achievable once you get going.) This would mean you need a net worth of $833,000 ($50,000 ÷ .06) to achieve financial independence. (For more details, check out my article How Many Rental Properties Do You Need to Retire.)

In case you didn’t notice, real estate’s income producing ability allows you to become financially independent with a much smaller net worth than alternative investments. In other words, you get to financial independence sooner!

Just another benefit of real estate investing! Now let’s pick a real estate investing strategy and niche.

Step 2: Focus on a Real Estate Investing Strategy and Niche

Real estate isn’t a single method of investing. I’ve found at least 35 different niches you could specialize in, and you could apply a variety of strategies to each of those niches.

A niche is just a small segment of the larger real estate market. This could be a particular neighborhood, a certain kind of property (single family, duplex, commercial building), or a certain customer (like vacation rental tenants).

A strategy is a method of making money. In very basic terms, real estate strategies fall under two big umbrellas:

- Flipping properties (buying and quickly selling).

- Holding for rental income and growth.

Within each of these larger strategies, you’ll find a number of sub-strategies. I’ll give you my favorites below.

Many brand-new investors get overwhelmed because there are so many choices. This leads to analysis paralysis or ineffectiveness as they jump from one niche to another.

To help you avoid this, I’ll recommend a few of my favorite beginner combinations of strategies and niches within real estate investing.

The Live-In House Flip

My friends and bloggers at 1500 Days to Freedom built a large part of their wealth ($1.6 million +) using a simple real estate method. It’s called the Live-in House Flip. [J.D.’s note: I too am a fan of the folks at 1500 Days. They’re funny and informative.]

Just like it sounds, this strategy involves flipping a house. But unlike most flips, you live in the house for at least two years.

Why live in the house? Because this allows you to sell the house tax-free. This is one of the most profitable sections of the U.S. tax code! (In the U.S., when you sell your primary residence, up to $250,000 of capital gains for an individual — or $500,000 for a couple — can be excluded from your income.)

No, it’s not always fun to live with construction dust. But what if you could use this strategy for a short period of your life, like 6-10 years? You could own your home free and clear or jumpstart your wealth building. And then you could move on with the rest of your life.

House Hacking

One of my first residences — I’ve had a lot! — was a four-plex. I lived in one unit and rented out the other three units. My mortgage payment including taxes and insurance was $1100 per month. My rent from the other three units was $1200. I was basically living for free!

If you don’t want to live in a small multi-unit building, you could also rent out a basement or garage apartment. I have a friend who rents his basement part-time using AirBnB and pays his entire home’s mortgage.

House hacking is also a great way to transition into non-owner occupied rental properties.

While living in the property, you can obtain an owner occupied mortgage. These mortgages have the best rates and terms, and they are the easiest to get. Then after living in the building for a couple of years, you can decide to move on to a new residence. But the old property can be kept as a long-term rental that cash flows well.

If you’re looking for a low cost of housing and your first rental property, it’s hard to beat this method.

Rental Debt Snowball

You’re probably familiar with the debt snowball, which is a great way to repay your debts one-by-one. The speed of your debt payoff snowballs because the cash flow gets bigger and bigger as each debt gets paid. This cash flow is then used to pay off the next debt even faster.

You can also do a debt snowball with rental properties. It’s one of the most predictable, satisfying ways to achieve financial independence with real estate investing.

Here’s how it works in brief:

- Buy the number of rental properties you need to achieve financial independence. (Remember, we covered that calculation in step one above.)

- Use the excess cash flow from all rentals (and any extra savings) to pay off one mortgage at a time.

- Repeat the process for each mortgage until you own all of the homes free and clear.

- Enjoy the income and equity from your free-and-clear properties to do what matters in your life.

Using this method, it’s possible to own your properties free and clear of debt in under thirteen years. (I wrote a detailed rental snowball example with numbers in case you’re interested.)

Now that you understand the big picture, let’s look at what makes a good real estate deal.

Step 3: Understand the Basics of Good Real Estate Deals

Good real estate deals are one part quantitative analysis (i.e. the numbers) and one part qualitative analysis (i.e. intangibles that make properties desirable). To buy good real estate deals that will make a profit and help you achieve financial independence, you need to understand both.

Quantitative Analysis of Real Estate

I can summarize financial analysis for rental properties with five key metrics:

- Net Operating Income. Your net operating income (NOI) is the rent left over after paying all of your property expenses, including taxes, insurance, property management, maintenance and reserves for vacancy and future capital expenses (roofs, HVAC systems, etc). Importantly, this metric does not include any mortgage expenses.

- Cap Rate. You know how folks use the price-to-earnings ratio (or P/E ratio) to evaluate stock prices? Well, the cap rate is a similar tool for evaluating home prices. The cap rate — which is short for capitalization rate — describes the relationship between the net operating income (or NOI) and the price of the real estate. Imagine, for example, a rental that produces $10,000 per year in NOI and can be purchased for $100,000. This hypothetical property would have a 10% cap rate. This metric ignores any debt used to buy the property and focuses only on the income and price. So, the formula is this: Cap Rate = NOI/Price.

- Net Income After Taxes. Net income after taxes is derived from a formula that builds upon the NOI. The key difference is that here you also deduct mortgage payments (if any) and tax liabilities. This is the money you’ll actually get to keep in your bank account, which I think we can all agree is a very important thing!

- Cash-on-Cash Return (ConC). Like a cap rate, your cash-on-cash return describes your return on investment. But the ConC rate usually assumes you have leverage and describes the cash return on your down payment. Imagine you purchase a property with a $20,000 down payment, for instance. If this property produces a $2000 yearly net income after taxes, then you’d be earning a 10% cash-on-cash return. The formula is this: Cash-on-Cash Return = Net Income After Taxes/Cash Invested.

- Price Discount. The final metric is straight-forward. How far below the full price did you pay? Unlike stocks, real estate is an illiquid market. This means there are opportunities — if you work hard — to buy a place anywhere from 10% to 30% (or more) below full value.

There are definitely many other ways to financially analyze a real estate deal. But if you understand these five core metrics, you’ll have the basics tools you need to buy a good deal.

Qualitative Analysis of Real Estate

Real estate is best viewed as a product. A lot of times, investors get caught up in the numbers, as if real estate is only a numbers game. But it’s not. In real life, people make emotional decisions to buy or rent. Qualitative analysis is all about understanding the factors that make any particular property more or less desirable.

Luckily, you’ve lived in real estate! So, when you buy residential real estate investments, you already understand some of the important factors that matter the most to renters and buyers.

But to jog your memory, here is a list of things to consider that affect the desirability of a property:

- Safety

- Walkability or accessibility of public transit (especially in urban areas)

- Good school districts (especially in suburban areas)

- Population growth in the region – increasing (good) or decreasing (bad)

- Job and wage growth in the region – increasing (good) or decreasing (bad)

- Low-traffic streets

- Outdoor living features (yard, patios, gardens, etc)

- Attractive interior finishes (this varies from market to market, but it’s important)

- Storage space (garages, storage lockers, etc)

- Quality construction and low maintenance materials (floors, exterior surfaces, etc)

- Interior layout (avoid weird wall locations, walking through bedrooms to get to bedrooms, etc)

- Avoid obnoxious neighbors, dogs, smells, large power lines, noises – you can’t control these things.

- Avoid steep lots or properties below the grade of the road. Water flowing towards your foundation is a difficult problem.

Real estate is very local. So, my list may not always apply to your market. But the main point is to study and learn the important factors in the area where you want to invest. You can do this best by becoming a renter or buyer yourself. Shop around. And then try to buy properties that meet both your quantitative and qualitative criteria.

Step 4: Build a Team

Real estate is a team sport. If you like to manage all of your investments from a computer and never talk to people, this may be negative. But you don’t have to be an extrovert or an amazing communicator to be the leader of your team. You just need to have a clear idea of what you want and then pay good people to help you.

Here’s a list of some of the key team members you’ll need to buy, finance, rent, and sell real estate investments:

- Real estate agent (for purchases and sales)

- Real estate attorney (for contracts, LLC creation, and for closings in some states)

- Certified Public Accountant (C.P.A.)

- Mortgage lender

- Personal banker (for your business bank accounts and lines of credit)

- Property manager (unless you are self-managing)

- Property inspector (during purchase due diligence)

- Repair contractors

- HVAC technician

- Plumber

- Electrician

- Pest control

- Lawn care

- Handyman

- Referral sources for new deals

- Networking and mentorship with other local investors

That might seem like a large list, but don’t let it intimidate you. You don’t have to build this team overnight. And you can share a lot of the team members with other investors as you network at local REIA groups or online at places like the Bigger Pockets forums.

Step 5: Create a Financing Plan

Real estate is closely tied to financing. Even in inexpensive markets, the price of an investment can be hundreds of thousands of dollars.

So, unless you already have a big pile of cash to invest, you’ll need to create a financing plan — and this needs to be done before you go out and start shopping for investment properties.

Here are a few things to figure out with your personal financing plan:

- The source (mortgage lender, local bank, private loan, line of credit)

- The terms:

- interest rate

- upfront costs (fees, points, closing costs, etc)

- the length of the loan

- fully amortizing or an early balloon payment.

- down payment requirement

- Loan amount available

As a general rule, I like my financing to have a low rate of interest, long length (30 years), and no balloons. When I started, I got most of my financing from non-bank, creative sources like private money, self-directed IRA loans, and seller-financing. (I shared my five favorite non-bank financing sources in an article at Bigger Pockets.) But over time I’ve used all sorts of financing, including traditional mortgage loans and commercial financing.

You’ll need to match your financing to your strengths. If you have great credit, solid W-2 income, and a down payment, then traditional financing may be the best route in the beginning. The rates are typically low and the terms are very attractive. But if you’re self-employed, newly employed, or any form of entrepreneur (like I was), then you may also want to look at alternative financing sources like I did.

As I’ll explain in the next section, it also won’t hurt to have multiple sources of money. Traditional financing has great terms but it can be very slow to close. Alternative financing may have less attractive terms but give you quicker access to cash for good deals.

Step 6: Create a Plan to Find Deals

The question I get most often is, “How do I find good real estate deals?” Especially in hotter markets, it seems like all of the good deals get snatched up quickly.

This was the skill that I learned at the very beginning of my real estate career. I didn’t know much else, but I recognized that finding good deals was like a bottleneck for all of the other parts of the business. Here are some of the key things I learned:

- Recognize good deals. Begin by understanding what a good deal looks like. (See step three in this article.) You won’t find good deals if you don’t know what you’re looking for.

- Prepare your financing (or cash). Get your financing prepared before you hunt for deals (step five above). Even better, if you have access to a source of liquid funds instead of just a traditional loan, you’ll improve your chances of buying good deals because you can move faster. This might be a line of credit, cash in the bank, a private loan, or a hard money loan. You can refinance with permanent financing later.

- Build a referral network. You want everyone you know to be looking for deals. You only have two eyes and 24 hours in a day. But if twenty people you know are looking for signs of good deals, you’re much more likely to stumble upon them. Begin by printing and passing business cards telling people what you do and what you’re looking for. If you’re hardcore like I was, you might even put signs on your car! I bought one house per year for many years from this one source alone.

- Build market systems. Your time is limited. You need to build systems to leverage marketing, such as direct mail, websites, Realtor MLS searches, and more. (You can check out my podcast interview on BiggerPockets for seven ways to find incredible real estate deals. I talk about direct mail and other favorite ways to generate leads.)

- Hustle. Nothing replaces your personal commitment and desire to hustle. This is the great equalizer. When I started, I knew very little. Other investors had financial and knowledge advantages over me. But I was proud that few people could out-hustle me. If you want to find good deals, you’ll need a similar commitment.

Keep in mind that finding deals is a lot like a treasure hunt. You have to turn over many, many stones before you find a gem. If you’re impatient and want quick results after looking at five properties, you’re not likely to succeed early on. When I was a beginner, I was told I’d need to look at 100 properties before I’d find a deal. This was like paying my dues. I still think it’s good advice today.

There is much more to learn in this area of real estate. But these tips should help you get started.

Step 7: Take Massive Action

“In life, lots of people know what to do, but few people actually do what they know.”

Anthony Robbins, Awaken The Giant Within

So far in this article, I’ve shared a lot of knowledge. We’ve gone from the big picture and theory of real estate down to the nitty-gritty of deal analysis and finding good properties to buy. But this final step is less about what you know and more about what you do. Ultimately, success in real estate investing — or anything else — comes down to personal commitment, organization, and self-discipline.

I often tell people that starting anything new, including real estate, is a game of momentum. It’s like you’re pushing a huge boulder down a hill. That boulder won’t budge without a lot of initial effort. But once you take massive action to get it moving, the rock will roll from its own momentum.

The key questions for you then are:

- Are you really committed to real estate investing? If it’s just whim, I’d recommend not wasting your effort. It’ll likely just lead to frustration for you and others.

- Are you organized with your projects and your time? I’m sure you have job, family, and other commitments already. Can you carve out 10-20 hours per week early on to push the boulder downhill, to build momentum? If not, perhaps you should wait until a time when you can.

- Are you willing to stick to this? Do you have enough self-discipline to keep going when it’s less fun, when the results don’t come easily, and when you’re tired? You’ll hit a wall, just like everyone else before you. What will you do when the wall comes?

The good news is that taking massive action can be a lot of fun! If you’ve made it this far (thank you for sticking with me!), you’ve proven you’re interested in real estate investing. Make a game out of learning and starting this new venture. Don’t take yourself too seriously when things go wrong. And celebrate when things go well.

In the end, what I love about real estate and all of personal finance is the personal growth you experience while you also build wealth. It’s a fun combination!

How Will You Get Started in Real Estate Investing?

Thank you for learning how to get started in real estate investing with me. I’ve shared my real estate story, the I.D.E.A.L. benefits of real estate, and seven baby steps to get started.

Now it’s your turn. I hope this information will inspire and equip you to get started with your own investments.

If you have any questions or need clarification on something, please feel free to leave a comment below. I’d love to hear from you!

The post How to get started with real estate investing appeared first on Get Rich Slowly.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment