Here’s my investment portfolio:

If you closely follow past articles about the stock market, they lead you to believe that “picking the right stock” is the key to financial success.

Nope.

Picking your asset allocation (i.e., choosing what your “pie chart” looks like) is more important than any individual stock.

If you want your own diversified portfolio, I can help you do that. I’ve helped thousands do it through my New York Times best-selling book already.

Let’s get started by taking a look at what being diversified actually means and how it can help protect you from the whims of the financial markets.

Asset allocation: How does it work?

If you bought all different kinds of stocks or stock funds, you’d be diversified — but still only in stocks. That’s like being the hottest person in Friendship, Wisconsin. It’s better than not being hot, but not going to get you cast in the next season of “The Bachelor.”

It is important to diversify within stocks, but it’s even more important to allocate across the different asset classes, the major ones being:

- Stocks and mutual funds (“equities”). When you own a company’s stock, you own part of that company. These are generally considered to be “riskier” because they can grow or shrink quickly. You can diversify that risk by owning mutual funds, which are essentially baskets of stocks.

- Bonds. These are like IOUs that you get from banks. You’re lending them money in exchange for interest over a fixed amount of time. These are generally considered “safer” because they have a fixed (if modest) rate of return.

- Cash. This includes liquid money and the money that you have in your checking and savings accounts.

Investing in only one category is dangerous over the long term. This is where the all-important concept of asset allocation comes into play.

Remember it like this: Diversification is D for going deep into a category (e.g., stocks have large-cap stocks, mid-cap stocks, small-cap stocks, and international stocks).

Asset allocation is A for going across all categories (e.g., stocks, bonds, and cash).

When determining where to allocate your assets, one of the most important considerations is the returns each category offers. Of course, based on the different types of investments you make, you can expect different returns. Higher risk generally equals higher potential for reward.

The fact that performance varies so much in every asset class means two things:

- If you’re investing to make money fast, you’re probably going to lose. This is because you have no idea what will happen in the near future. Anyone who tells you they do is lying.

- You should own a variety of assets in your portfolio. If you put all your money in U.S. small-cap stocks and they don’t perform well for a decade, that would really suck. Instead, if you owned small-cap, large-cap, with a variety of bonds, you’re more insured against one investment dragging you down.

You don’t want to keep all your investments in one basket. Keep your asset allocation in check by buying different types of stocks and funds to have a balanced portfolio — and then further diversifying in each of those asset classes.

A 1991 study discovered that 91.5% of the results from long-term portfolio performance came from how the investments were allocated. This means that asset allocation is CRUCIAL to how your portfolio performs.

Now that you know the basics of asset allocation and diversification, I’m going to give you one diversified portfolio example you can base your portfolio on AND give you a look into my own portfolio.

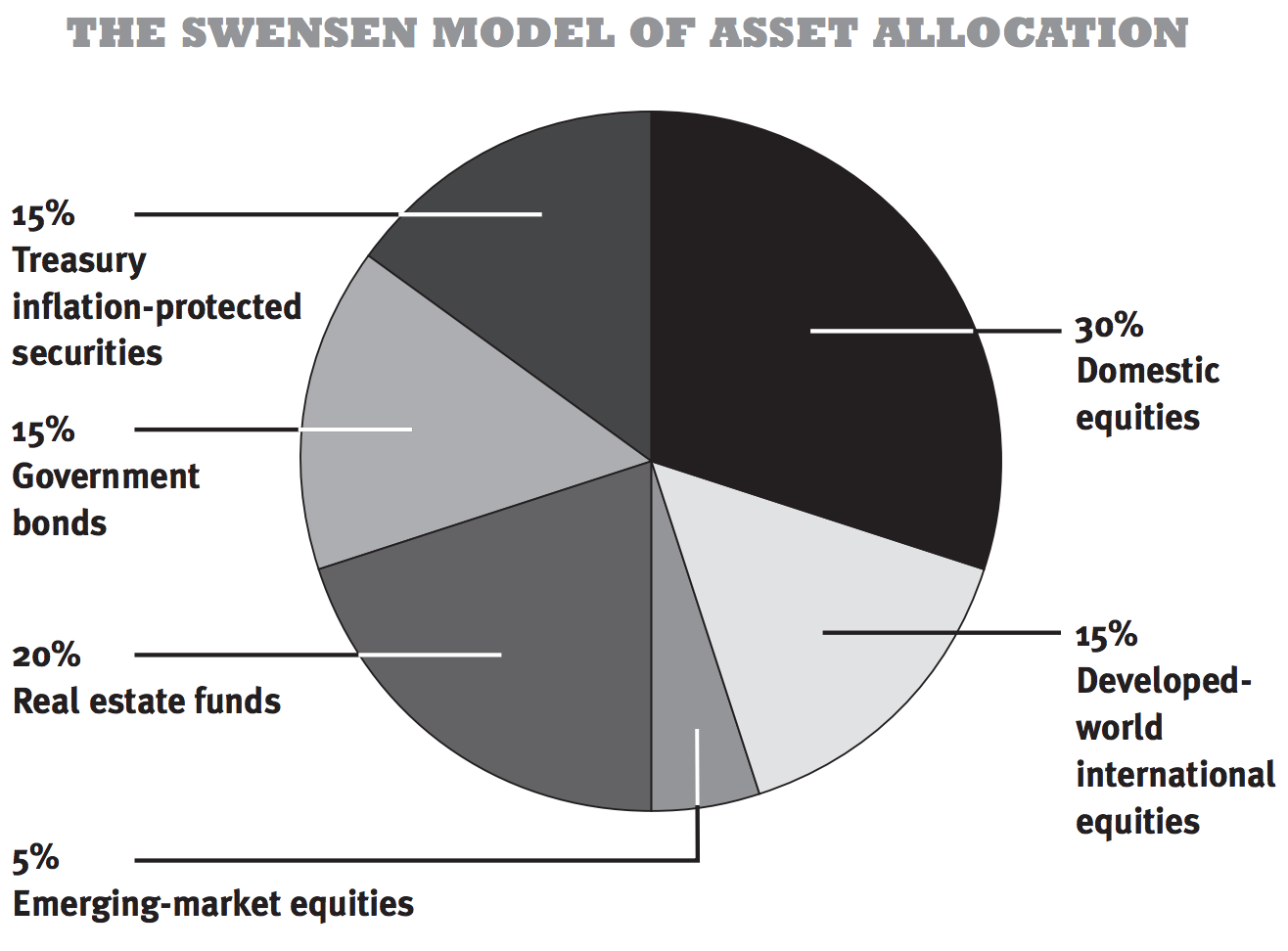

Diversified portfolio example #1: The Swensen Model

Just for fun I want to show you David Swensen’s diversified portfolio. David runs Yale’s fabled endowment, and for more than 20 years he generated an astonishing 16.3% annualized return — while most managers can’t even beat 8%. That means he’s DOUBLED Yale’s money every four-and-a-half years from 1985 to today, and his portfolio is above.

David is the Michael Jordan of asset allocation and spends all of his time tweaking 1% here and 1% there. You don’t need to do that. All you need to do is consider asset allocation and diversification in your own portfolio, and you’ll be way ahead of anyone trying to “pick stocks.”

His excellent suggestion for how you can allocate your money:

|

ASSET CLASS |

% BREAKDOWN |

|

Domestic equities |

30% |

|

Real estate funds |

20% |

|

Government bonds |

15% |

|

Developed-world international equities |

15% |

|

Treasury inflation-protected securities |

15% |

|

Emerging-market equities |

5% |

|

TOTAL |

100% |

What do you notice about this asset allocation?

No single choice represents an overwhelming part of the portfolio.

As illustrated by the tech bubble burst in 2001 and also the housing bubble burst of 2008, any sector can drop at any time. When it does, you don’t want it to drag your entire portfolio down with it. As we know, lower risk generally equals lower reward.

BUT the coolest thing about asset allocation is that you can actually reduce risk while maintaining a solid return. This is why Swensen’s model is a great one to base your portfolio on.

Now let’s take a look at another handsome investor…

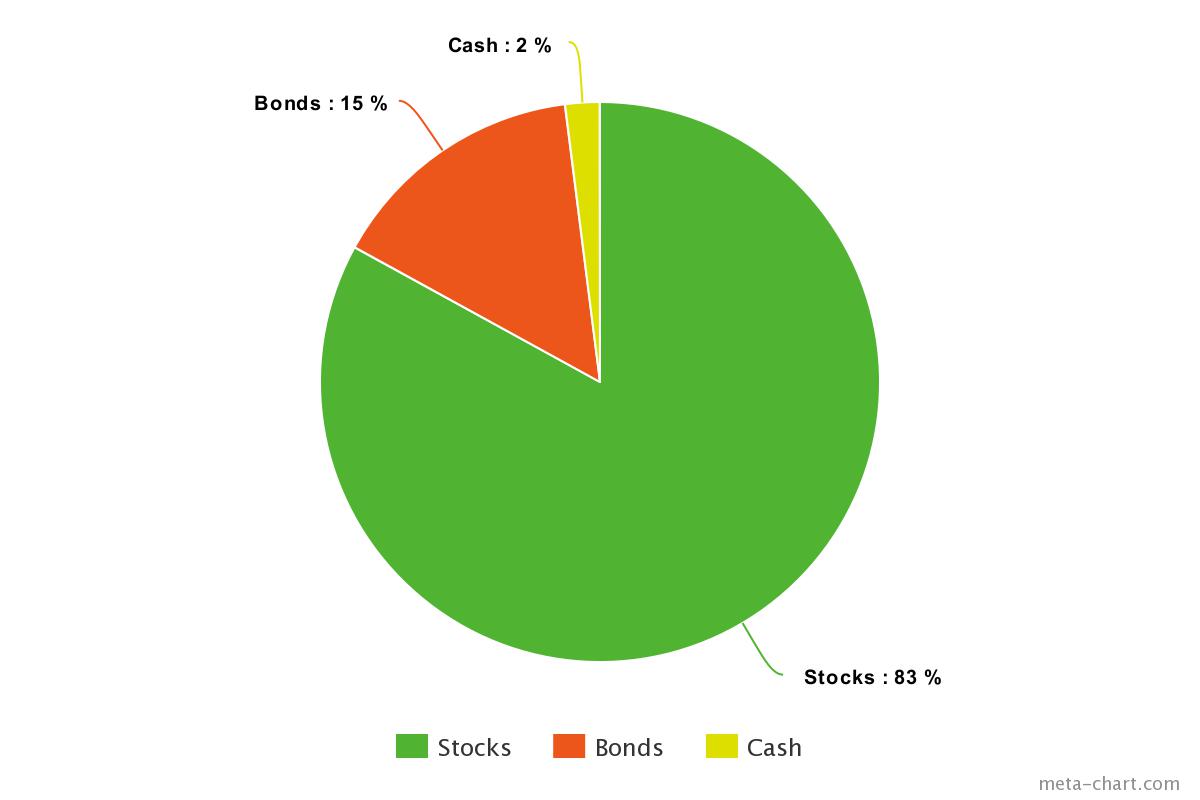

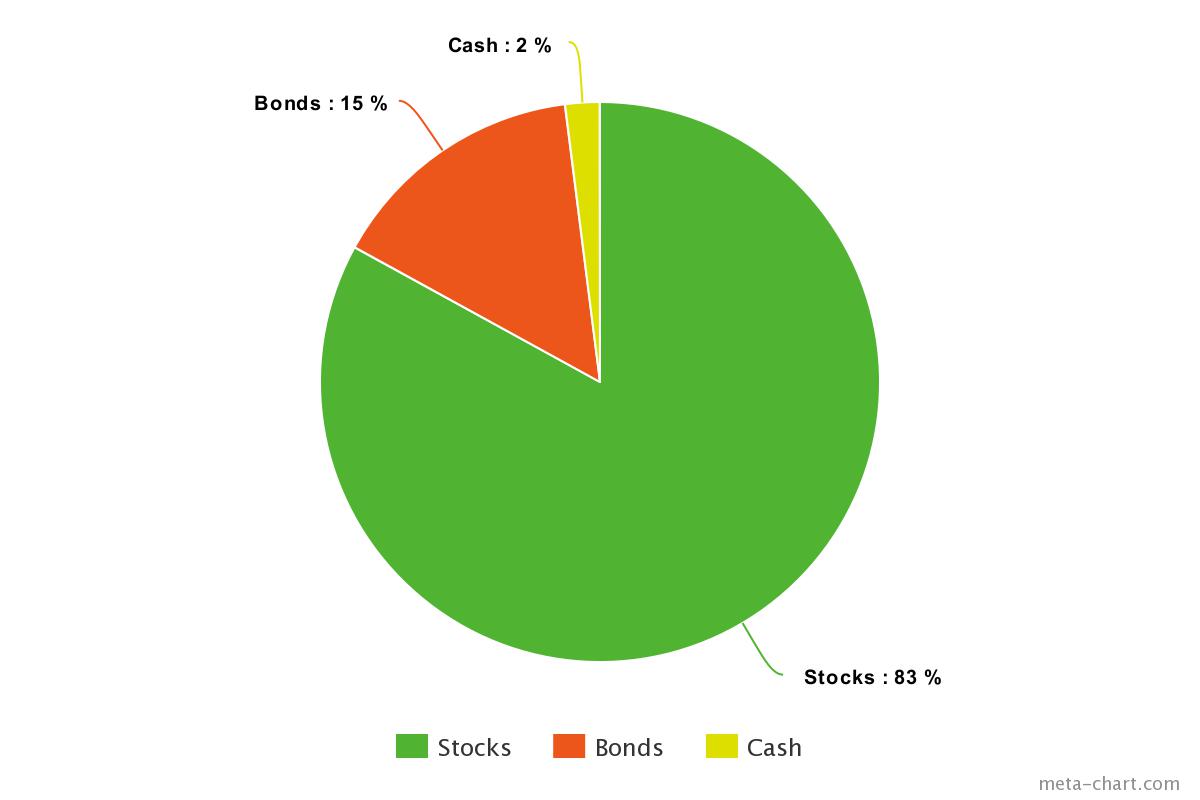

Diversified portfolio example #2: Ramit’s diversified portfolio example

This is my investment portfolio. I spent quite a while getting it right, but once it’s set, you don’t have to change it often.

The asset classes are broken down like this:

|

ASSET CLASS |

% BREAKDOWN |

|

Cash |

2% |

|

Stocks |

83% |

|

Bonds |

15% |

|

TOTAL |

100% |

Let me provide three pieces of context so you understand the WHY behind the numbers:

Lifecycle funds: The foundation for my portfolio

For most people, I recommend the majority of investments go in lifecycle funds (aka target-date funds).

Remember: Asset allocation is everything. That’s why I pick mostly target-date funds that automatically do the rebalancing for me. It’s a no-brainer for someone who:

- Loves automation.

- Doesn’t want to worry about rebalancing a portfolio all the time.

They work by diversifying your investments for you based on your age. And, as you get older, target-date funds automatically adjust your asset allocation for you.

Let’s look at an example:

If you plan to retire in about 30 years, a good target date fund for you might be the Vanguard Target Retirement 2050 Fund (VFIFX). The 2050 represents the year in which you’ll likely retire.

Since 2050 is still a ways away, this fund will contain more risky investment such as stocks. However, as it gets closer and closer to 2050, the fund will automatically adjust to contain safer investments such as bonds, because you’re getting closer to retirement age.

These funds aren’t for everyone though. You might have a different level of risk or different goals. (At a certain point, you may want to choose individual index funds inside and outside of retirement accounts for tax advantages.)

However, they are designed for people who don’t want to mess around with rebalancing their portfolio at all. For you, the ease of use that comes with lifecycle funds might outweigh the loss of returns.

For more information on lifecycle funds, check out my three-minute video on the topic below.

Minimal speculative investments

Speculative investments are dangerous.

These are investments that have the potential to earn a lot of money but also have the potential to lose big.

For example, when I just started out, I bought a bunch of stocks because that’s what I thought investing was. And there were three tech companies that I initially invested in. Two of them ended up going bankrupt — but I also bought stock in a little company called Amazon.com.

Guess what? I made a good amount of money off of that investment … and it’s not because I was smart. I was stupid. I just got incredibly lucky.

The lesson here isn’t “find the next Amazon.” It’s that you don’t know how to get lucky. I happened to stumble on dumb luck.

It’s possible that the next hundred companies I invested in went belly up because speculative investing is total gambling. If you’re young and just getting started, you’re probably going to want to be more aggressive since you’re better positioned to risk more — sensibly. (More on this in my book.)

No matter what, you still want to make sure you’re diversified to help safeguard yourself against the worst financial situations.

That’s why I spent years getting my asset allocation right — and that’s why I’m happy you’re here.

If you’re interested in things like diversifying your portfolio, I want to give you something that can help you start building that portfolio today.

In it, you’ll learn how to:

- Master your 401k: Take advantage of free money offered to you by your company … and get rich while doing it.

- Manage Roth IRAs: Start saving for retirement in a worthwhile long-term investment account.

- Spend the money you have — guilt-free: By leveraging the systems in this book, you’ll learn exactly how you’ll be able to save money to spend without the guilt.

Enter your info below and get on your way to living a Rich Life today.

Diversified portfolio examples: A guide to diversification is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment