Learning how to make $100,000 is a common goal for many entrepreneurs — and why wouldn’t it be?

Here’s a list of things you can get with $100,000:

- An actual jetpack

- Country legend Willie Nelson to perform at your birthday party

- A private island off the coast of Ontario, Canada

There are many ways you can get to earning six figures a year. The two most common ways are:

- Getting a job that pays six figures a year

- Starting a side hustle and scaling it so you’re eventually making six figures a year

However, it’s not going to be easy. Building out a side gig so that it helps you earn six figures a year is going to take time, a few sacrifices, and sweat equity. So does up-leveling your full-time job. But what’s below is a system that has been followed by thousands of our students successfully.

BUT WAIT! Before you start building six figures …

Repeat it with me: The biggest barrier in the way of a Rich Life is debt.

The biggest barrier in the way of a Rich Life is debt.

The biggest barrier in the way of a Rich Life is debt.

The biggest — you get the picture.

Before you even think about systems and tactics to scale your earnings to six figures, you need to get out of debt.

Once you do, and you begin to earn more, you’ll find that paying off any regular debts you might have is actually empowering instead of debilitating.

“I’m surprised at how my relationship with debt has changed,” says Bonnie Gillespie, author of Self-Management for Actors. “I see student loans and credit card bills as investments others made in me and my ability to be good for the money they fronted me. When I write checks to pay these bills, in my mind they’re thank-you notes to those early investors. I know not everyone has the same relationship with debt that I do.”

You can start to actually frame your debt as an investment rather than just something you owe.

“What has surprised me about being consistently in six figures is how much FREEDOM I feel in being able to take a machete to my debt,” Bonnie says. “Writing checks for five figures to MasterCard every month to just hobble that debt feels massively empowering in ways I wasn’t aware would free me.”

If you’re in debt now and you want to take steps to get out of it, be sure to check out Ramit’s video on the topic below.

How to earn six figures a year

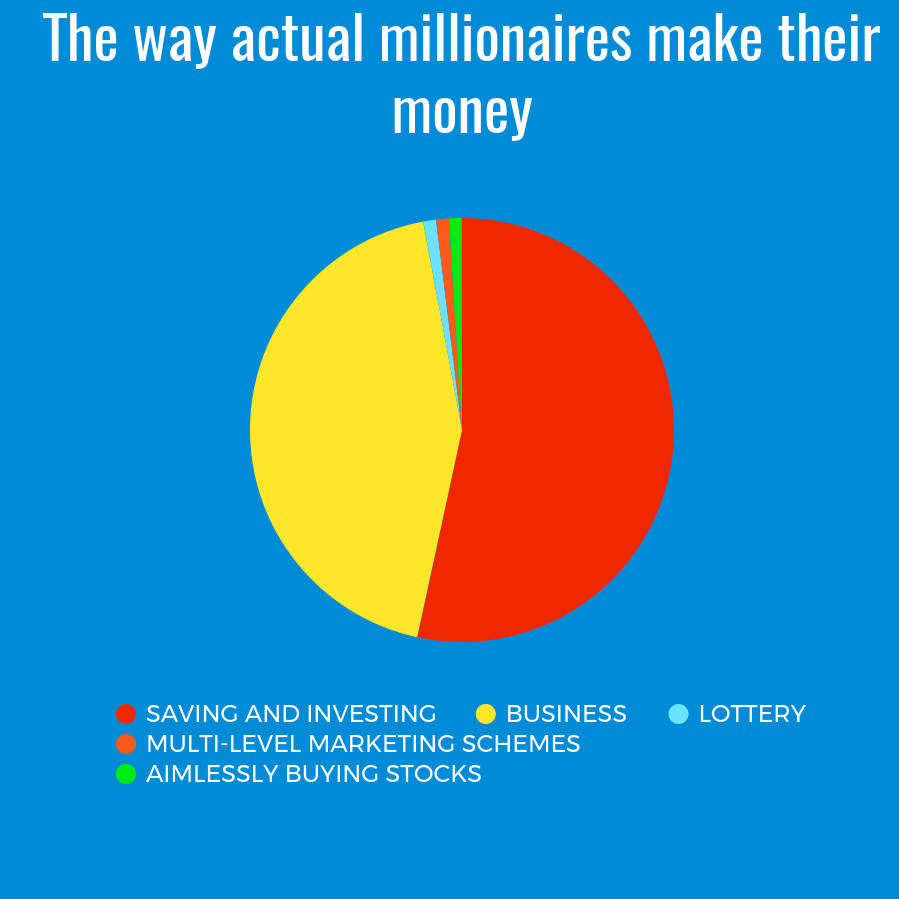

A while back, we spoke with two millionaires about how they made their riches.

Longtime IWT readers shouldn’t be too surprised to learn that they didn’t earn their millions through weird MLM schemes or buying lottery tickets, but through the powerful combination of saving / investing and starting a business on the side.

We regularly receive THOUSANDS of emails from people who have made six or seven-plus figures and if you asked me to break down how they did it in pie chart form, it might look something like this.

For this article, we talked to a number of people who scaled their income to six figures and more. We found that their strategy was no different — albeit with a few idiosyncrasies.

- Step 1: Set up your Tripod of Stability

- Step 2: Earn more money in your career

- Step 3: Find a side hustle

- Step 4: Get your first client

- Step 5: Charge the perfect price

- Step 6: Invest in yourself

Let’s get started.

Step 1: Set up your Tripod of Stability

When you have a goal as ambitious as “I want to earn a six-figure income,” it’s easy to lose sight of the really important things in your life.

I’m talking about the basics: food, water, shelter, etc.

This is the “Tripod of Stability” — all of the foundational, big aspects of your life that you keep ultra-stable so you can take risks in other areas.

“I’m a proponent of part of the Tripod of Stability,” says Naveen Dittakavi, founder of NextVacay.com. “If you have a day job, you need to ensure that it’s stable. You have to carve an ability to work on your side hustle while doing great work at your day job.”

He continues, “I lived at home for six years. My parents were really cool and helped me get by while I built out my business.”

Naveen recently scaled his hustle so that he’ll be taking away roughly $1 million this year (so you know he knows his stuff).

By taking care of your big things — your home, car, relationships, food — you’ll be able to take risks in areas like your side business. As Ramit says, when you have your bases covered, you’re not really taking risks at all.

Your Tripod of Stability doesn’t necessarily mean that you’re free of sacrifices though. If you want to devote yourself to making six figures a year, you’re going to have to change some of your habits and beliefs.

“I sacrificed a lot to build my business,” Naveen recalls. “After all, living at home with your parents for six years means you’re going to be single for six years — BUT it gave me what I wanted out of my life.”

Action step: Identify your Tripod of Stability

Write down the three main “legs” of your Tripod of Stability. These are the things that, if they remain constant, would allow you to weather dramatic changes in other areas in your life. It could be things like:

- Your home

- Your car

- Your job

- Your wife/husband

- Your savings account

Once you know what makes up your Tripod of Stability, you can make sure you have those areas secure so you can start taking risks in areas like starting a side hustle.

Step 2: Earn more money at your day job

If you’re looking to build a six-figure income on freelancing with your side hustle alone, you can skip this step.

If having a job is one of the legs for your Tripod of Stability, though, you’re going to want to maximize your salary as much as possible.

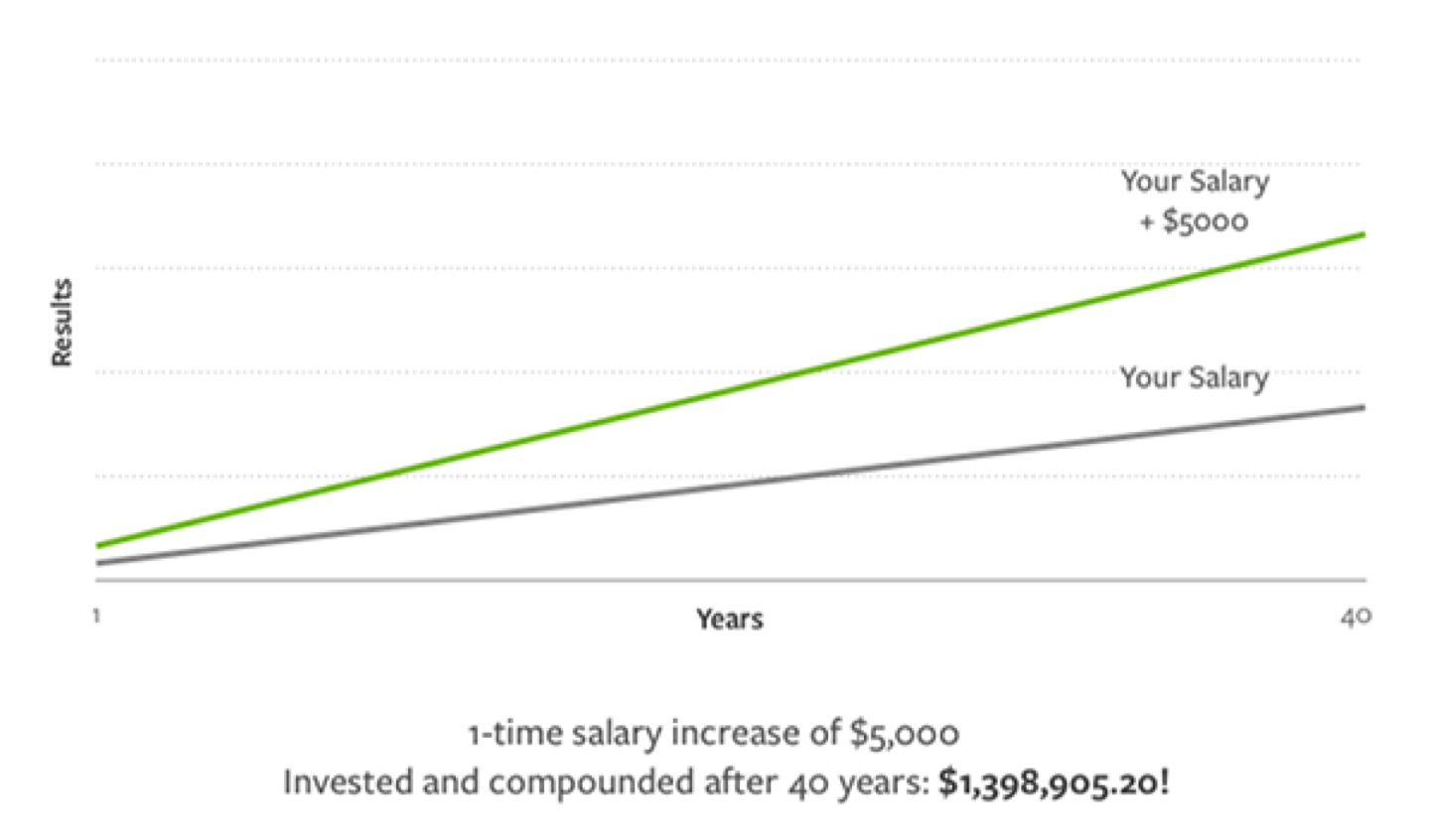

Why? The more you earn, the closer you’ll get to your first six-figure year. There’s no better way to do that than to negotiate your salary.

Check out this chart that shows how much a $5,000 increase in salary can add up over the years:

Not only is it a BIG win, but it also sets you squarely on the road to earning more after just one conversation with your boss.

And the first step to do this is actually straightforward — but many people still forget it: Do good work.

“First and foremost, you have to deliver great results,” says IWT reader and six-figure earner Enoch Ko. “Without results, no amount of networking or relationship building can get you [to six figures]. That said, you have to build good relationships at work along with delivering great results.”

“Results and relationships go hand-in-hand,” he continues. “Once I had proven myself to be a Top Performer, higher salary was just a matter of time — having regular salary discussions with my managers and skip-level managers, working out timing with the corporate planning cycles, etc.”

Once you prove yourself to be an invaluable asset to your company, begin to build two of the most important tools at your disposal: your network and your observations. Enoch made such an impact he eventually moved on to another role that he was referred to by … his current manager.

“It was through building good, trusting relationships through delivering great results that helped,” he says.

One thing that can have a HUGE impact on salary negotiations is showing you can add even more value in the future.

A great way to do this is simply by asking questions of your manager:

- What’s something that you would like to improve within the company — and how can I help?

- What traits do you value the most in a new hire?

- How can I help with your most important goal this quarter?

Not only will this show that you have initiative but it also gives you insight into exactly the kind of talking points that will grand slam your salary negotiation.

Action step: Prepare for your salary negotiation

Check out our resources all about how to prepare for your salary negotiations. A few great places to start:

- The Ultimate Guide to Getting a Raise and Boosting Your Salary. The definitive guide on how to ask for the raise you deserve.

- How to use Natural Networking to connect with anyone — including the exact email scripts. If you think networking is sleazy or scammy, it’s because you’re doing it wrong, or worse – you’re pre-emptively shooting it down out of fear.

- Master Class: Negotiating Salary. Ramit Sethi and Susan Su walk you through the exact tactics, scripts, and systems you should use when negotiating your salary.

You should also prepare one of IWT’s favorite interviewing tactics: The Briefcase Technique.

This is perfect for interviews, salary negotiations, client proposals, whatever! The best part: 90% of the work is already done before you even walk into negotiations.

Here’s how it works:

First, you’re going to leverage the information you’ve gleaned from observing the company and write up a 1-5 page document describing the areas of the company where you can add value.

Then, you’re going to bring the proposal with you when you negotiate your salary. When the question of compensation inevitably arises, you’re going to pull out this document and outline exactly how you’re going to solve the challenges of the company.

Hiring manager: So what’s your price range?

You: Actually, before we discuss compensation, I’d love to show you something I put together.

And then you literally pull out your proposal document detailing the pain points of the company and EXACTLY how you can help them.

This shows the company how you’re the person who’s going to add value in those areas, making you an incredibly valuable employee they’ll want to pay more to keep around.

Ramit discusses The Briefcase Technique in depth in this two-minute video. Check it out below.

BONUS: If you want more information on how to earn your Dream Job, check out our resources below to help you out.

- How to find your Dream Job. A comprehensive resource on all things related to finding a career you’ll love.

- How to stand out to hiring managers. Learn the exact system to use to help you look like the obvious choice to companies.

- How to use Natural Networking to connect with anyone. Networking doesn’t have to be a pain. It can actually be really fun.

Step 3: Find a side hustle idea

This is the number one barrier holding people back from creating their side hustle.

After all, you’re looking for something that’s profitable and that you’re passionate about.

And the Venn diagram between those two things often seems like two separate circles.

Luckily, you already have profitable skills already. That’s what Christina Nicholson of Media Maven realized when she left her job after years of experience as a television news reporter and started working for a PR agency.

“Like many people, I didn’t have a great boss,” Christina recalls, “and more attention was paid to the hours I was sitting in front of my desk in the office instead of the quality of work I was executing.”

That all changed when one day a client came in to pay his retainer and Christina discovered that it was more than what she made in one month.

“That’s when I realized I could do all the work AND keep all the money,” she says. “I didn’t need to work for someone who caused me unnecessary stress. I didn’t need to get vacation approved or be on the receiving end of an attitude when I needed to leave the office early because I had a sick child.”

She continues, “I could also do other things, like host local and national TV segments on a freelance basis.”

So she began to build out Media Maven, her hustle to help other businesses get a handle on their PR. “After starting my business,” she recalls, “I saw what was possible and it motivated me, even more, to learn more about entrepreneurship and take things to the next level.”

That’s not the only way you can find a profitable freelancing idea either. There are actually four questions you can ask yourself right now to find an idea you can leverage for your hustle:

- What do you already pay for? We already pay people to do a lot of different things. Can you turn one of those things into your own online business? Examples: Clean your home, walk your pet, cook you meals, etc.

- What skills do you have? Now, what do you know — and know well? These are the skills you have that you’re great at — and people want to pay you to teach them. Examples: Fluency in a foreign language, programming knowledge, cooking skills, etc.

- What do your friends say you’re great at? Not only can this question be a nice little ego boost — but it can also be incredibly revealing. Examples: Workout routines, relationship advice, great fashion sense, etc.

- What do you do on a Saturday morning? What do you do on a Saturday morning before everyone else is awake? This can be incredibly revealing to what you’re passionate about and what you like to spend your time on. Examples: Browsing fashion websites, working on your car, reading fitness subreddits, etc.

Find an answer to those questions and I promise you you’ll find a great freelancing idea.

Action step: Find a profitable idea

Spend about 10-20 minutes now writing down five answers for each of the four questions above. Once you’re done, congratulations — you now have 20 potential business ideas that you can grow into a flourishing side hustle.

For now, just choose one business idea. It’s okay, you can always change it later. For now, we’re going to just try one out and try to find a client with it.

Step 4: Get your first client

In order to start earning money, you need to find the people who will give you money for your ideas.

But the question is … how? Where do you find these people?

Naveen’s tactic? Offering mouthwatering value.

“I was really involved in a lot of entrepreneurial aspirational groups,” he explains. “So entrepreneurs would hang out there and I would find ways I could add value. I wasn’t trying to pitch or close deals. I would just say that I had a computer science degree and, ‘I can help you clarify your vision and understand what it takes to build it out.’”

“I’ve always been helpful,” Naveen continues. “I started to find that being helpful to other people builds trust and will result in sales. I was in a position where there was limited talent to execute tech projects and there wasn’t a lot of people to help aspiring entrepreneurs.”

By doing this, Naveen did two very important things when it comes to finding clients:

- He went to where the clients lived. By going to exactly where his target market hung out, he was able to build a network of potential clients and people he could help.

- He offered amazing value. Naveen recognized an opportunity to show his potential clients that he was the man to help them. This value-add helped him gain his first few clients.

You can do the same thing.

Ask yourself:

- Who is my client?

- Where do they go when they want to look for a solution to their problems?

- Where are they ALREADY looking for solutions to their problems?

- How can you connect them to your service?

At this point, you’re also going to want to niche down your market in order to really tailor your services and draw in customers. So think about who’s an example of a client who might want to buy your product.

A few questions to jump-start your research:

- How old are they?

- Where do they live?

- What are their interests?

- How much do they make?

- What books do they read?

Using this information, find out what your clients need by going to the places they go.

For example:

- Want to pitch to moms that blog about children? Go to The Mom Blogs and start with the ones under “Popular Blogs.”

- Looking for physical or massage therapists within 50 miles of your house? Yelp should get you started easily.

- If you want to do large dog grooming and sitting, well there’s probably a local pet store or dog park near you where owners are all congregating just waiting for you to offer them a solution.

Here are a few suggestions of some other great sites freelancers can use to find business online:

- Writers: MediaBistro.com, Upwork.com, FreelanceWritingGigs.com

- Illustrators/designers: 99designs.com, Designs.net

- Programmers: Toptal.com, SmashingMagazine.com

Once you find a potential client, you’re going to want to reach out to them and pitch your services.

Action step: Find a client and email them (with scripts)

Find your client using the information I’ve outlined above. Let’s say you are a video editor looking to pick up some side work. Here’s a handy script you could use (just replace the “video editor”–specific stuff with your skill):

CLIENT’S NAME,

I saw your post on X and visited your website. I noticed that you’ve recently started using videos too.

I’ve been doing video editing for three years and I’d like to offer to help you edit your videos and get them optimized for the web.

That would make them look more professional and load faster, which is important for your readers. And you’d free up time that you could use to create new content.

We can discuss the details, of course, but first I wanted to see if this is something you might be interested in.

If so, would it be okay if I sent you a few ideas on how to help?

Best,

Joe Example

A few takeaways:

- There is zero fat in the pitch. Every word counts and is needed to help really sell the benefits of working with you.

- Don’t mention payment. There’s nothing that will kill a potential client’s interest in you more than pushing prices on them before they’re ready.

- Stress the benefits. This email shows the client why it would be in their best interest to buy from you in the third paragraph.

Once you get a client using this email, congrats! You just secured your first client — but it doesn’t end there. You need to actually do the work for them, and that means continually adding value.

“Being super aware of how you can help people and how they perceive you and recognizing that money will come if you’re valued by your audience helps most,” Naveen explains.

Step 5: Find out the true cost of earning six figures a year

You need to make at least $100,000 a year if you want a six-figure income. That means making at least:

- $8,333.33 a month, or

- $2,083.33 a week, or

- $416.66 each workday, or

- $52 an hour.

That’s simple back-of-the-napkin math. What isn’t obvious though are the hidden costs — the expenses you don’t take into account when you’re deciding how much you want to make.

“When I started out, I just took $100,000 and divided it up into an hourly wage so it came to about $52 an hour,” recalls Naveen. “That was dumb though. I didn’t even think about health insurance, retirement, vacation, or anything else.”

When you’re setting out to make six figures a year, you need to keep in mind what that actually means. Once you do that, you can set a proper goal for how much you want to make a year.

So before you jump into any system to make six figures, take into account any and all expenses you might have in a year, including:

- Utility bills (internet, water, electricity, etc.)

- Rent

- Car/home payments

- Food/groceries

Any living expense should be accounted for. Also make sure you account for your salary if you have a day job.

Once you do this, you’ll be able to get a sense of what earning six figures truly means, and you can begin to charge your clients what you want.

Action step: Charge what you’re worth

Now it’s time to do some back-of-the-napkin math to figure out exactly how much you want to charge to make six figures.

Don’t worry, it’s pretty simple. Take your expenses that you calculated above and add it to $100,000. Subtract your yearly salary and voila! You have roughly how much you should be earning per year through your side hustle.

You don’t have to go crazy with this. A ballpark number is just fine when you’re starting out.

If you really want to get into the weeds, you can even take into account state and federal taxes as well.

And while there are no set rules for rates, there are actually a few methods you can use to find one that works for you.

- Drop Three Zeros Method

Simply take your ideal (read: realistic) salary, drop three zeros from it, and voila, you have your hourly rate!

For example, say you’d really like to earn at least $40,000. Just take the three zeros from the end and you now have your rate: $40/hour.

- Double your “resentment number”

I love this one because it’s both really interesting and effective. Ask yourself: What’s the lowest rate you’ll work for that’ll leave you resentful of your work?

Say you’ll work for $15/hour at the VERY LEAST. Just double that number, so now you’ll earn $30/hour.

- Do what the next guy does

This method is incredibly simple: Go to Google and search for the average hourly rate for whatever service you’re providing. You’ll get a good sense of where to start when you’re charging your clients.

The best part is after you start charging your clients, you can start to take on more or less work until you earn the amount you want.

For example, after you earn your first $1,000, it’s incredibly easy to start dialing your prices up and charge even more money from your clients.

Start “tuning” your rates after your first few clients. Were you making $30/hour? Start charging $40 or even $50. There’s no hard and set rule for how much you should charge. Just start tuning until you find a rate you’re happy with.

Step 6: Invest in your finances AND yourself

Investments can take all shapes and forms. Let’s walk through three areas where you can start to invest when it comes to building out your six-figure life.

Investment #1: Personal finance

This is IWT’s bread and butter and an area where we have extensive resources.

It’s also a very important leg anyone should have on their Tripod of Stability.

The easiest way to get started ensuring your personal finances are in order is by automating your finances.

This is Ramit’s system of sending your paycheck where it needs to go each month (utilities, rent, cell phone bill, etc.) so you don’t have to worry about it.

“Being financially conservative, I have also automated my cash flow so that I automatically have savings and investments,” Enoch says. “I enjoy not having to think about savings and investments. I enjoy being able to spend money without worrying whether I’d have enough cash to pay for the highly cyclical quarterly gas bill or bimonthly electricity bill when they come.”

“Automation is incredibly important,” Naveen says. “At the time I was drawing a wage from my day job, it was helpful to put my trust in a system that made sense and would work out in the end. At the time, I was putting cash away in my ING Direct account and my sub-savings accounts. I was able to see that number increase and I saw it worked really well.”

Automating your finances only takes one to two hours at the most, but once you set it up, you don’t have to worry about it again.

AND it’ll save you thousands of dollars over your lifetime.

Here is a 12-minute video of Ramit explaining the exact process below.

Investment #2: Your side hustle

You’re going to reach a point in your side hustle where you’re going to have to put back some money into it if you want to grow.

That could take the form of hiring employees, buying a website domain, or getting a mentor / coach as was Christina’s case.

“It sounds cliche, but working smarter instead of working harder is how I reached six figures,” Christina explains. “How do you work smarter? You surround yourself with people who are smarter than you and have already achieved what you’re working for.”

So she hired a business coach and found someone to help her build out her business.

“I really did my homework,” she says. “I hired someone with a team of people, all of which were successful entrepreneurs earning at least multiple six figures, many of their clients were earning at least multiple six figures, and the coaching team had a very high retention rate, which told me they must do something right!”

That’s just one example though. You can find many ways to put money back into your business to help it grow.

BONUS: If you’re ready to take the next step, be sure to sign up for the 6-Figure Consulting wait list. This is our premier course on finding high-value clients, scaling our business, and building a model that generates 10x more revenue.

One great way to invest is to seek out mentorship or purchase a product or a book — which brings us to …

Investment #3: Yourself

Possibly the best investment that you can make is putting money in developing yourself both career-wise and on a personal level.

“My biggest investment is self-care,” Bonnie says. “The first thing on the calendar each month is Pilates, pole fitness, massages, day spa visits, couples therapy, quick getaways to Desert Hot Springs, and so on. If I’m not my best self, I’ve got nothing to bring my clients. It’s just stupid important, as investments go.”

LOVE IT.

This is exactly in line with Ramit’s abundance mentality. Who cares if this seems like a luxury? Who cares if people might scoff at the idea of getting a massage? What matters is that YOU want it and that YOU are willing to work for it.

The best way to get started is to begin investing in yourself.

Now, one thing that you will find very common with people who have not taken the time to invest in themselves and learn how this stuff works, is they will create what’s called levels of abstraction.

Rather than just going directly to what they want, they will create all these different levels of abstraction — like making a Facebook page or a blog — that make them feel good, but that actually don’t require them to do the hard work.

So, they’ll spend six, nine, twelve months doing something frustrating and then give up because they never spent time buying a couple good books or buying a course.

That’s why we want to offer you a proven system that’s helped thousands of students earn tens of thousands of dollars a month — for FREE:

You’ll discover:

- The three fears you MUST overcome if you want to make it as a 6-figure freelancer

- How to become a highly sought-after expert (Hint: It has nothing to do with credentials or degrees)

- How to figure out if an idea is profitable before investing time and effort

- The six parts to an email pitch that clients can’t refuse

- The Briefcase Technique that’ll make potential clients choose you over anyone else

- And much more!

Enter your name and email below to get the free handbook.

How to make $100,000 a year is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment