Yesterday I wrote about why it’s important to prepare for an uncertain future. It’s tough to predict where we’ll be (and who we’ll be) in five or ten years. It’s even tougher to predict what’s going to happen in the world around us. In order to cope with this uncertainty, it’s important to be adaptable — and to prepare for the worst (while expecting the best).

I was reminded of this advice again this morning as I read several articles in a row about the insane rise of Bitcoin and the current bull market in stocks, which is one of the longest in U.S. history.

Here’s a graph of the rise of the S&P 500:

Here’s a graph of the value of Bitcoin:

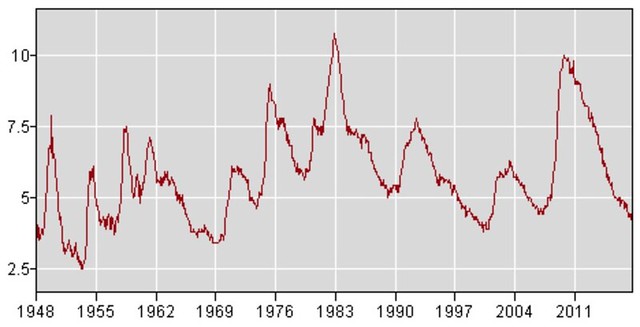

And, just for kicks, here’s a graph of the U.S. unemployment rate (in this graph, lower numbers are better):

You can look at just about any economic indicator over the past decade and produce similar graphs. Despite what certain incessant whiners say, we’ve experienced a period of sustained wealth and prosperity. That’s awesome!

If you’ve spent all (or most) of your adult life in this economy, you might believe it’s always like this. You might believe the stock market always goes up, jobs are always easy to find, and every day is sunny.

But it doesn’t work like that.

Summer or Autumn?

My friend William Cowie likes to use a metaphor when describing the U.S. economy. He says our economic cycles are like the four seasons.

He writes:

The key insight which will help you benefit from any given economic cycle is understanding that every complete cycle, bottom to bottom, has four phases, which I liken to the four seasons of a year: The spring of the early recovery, the summer of growth (everyone’s favorite season), the fall season of harvest, and the winter of recession.

Here’s a graph he uses to visualize the four seasons of the economy:

If we use past history as a guide — and again, we have nothing better to go on — where do you think we are in this cycle? We know we’re not in winter because things are too good. Are we in spring? Absolutely not. Are we still in summer? Maybe — but probably not. If we are, we’re in late summer. Odds are we’re in the autumn of the economic cycle, the time for “harvesting” our gains.

But here’s the thing: After the wild growth of summer, after the markets have shown sustained gains and unemployment is down, and prosperity is all around, that’s when most people start to feel safe. They breathe a sigh of relief. They let down their guard. They start to take risks they wouldn’t otherwise take. They pile on the already hot markets — buying high (then selling low in winter).

Not me. It’s at times like this that I get nervous.

Warren Buffett famously said: “Be fearful when others are greedy and greedy only when others are fearful.” Based on my reading this morning, people have become greedy. And that makes me fearful.

Winter is Coming

Re-reading what I’ve written so far, I sound like Ned Stark from Game of Thrones. His family’s motto is “winter is coming”. Because they live in the far north of their fictional country, the Starks strive constantly to be prepared for the cold and the dark. I guess that’s what I’m advocating too.

I’m generally an optimistic guy, but my optimism is tempered with pragmatism. As my pal Jim Collins says, market crashes are to be expected. “What happened in 2008 was not something unheard,” he says. “It has happened before and it will happen again. And again.”

Here’s his advice:

Toughen up and learn to ignore the noise, stay the course and ride out the storm…To do this, you need to know these bad things are coming. They will happen. They will hurt. But like blizzards in winter they should never be a surprise. And, unless you panic they won’t matter.

If winter is coming, what can you do to prepare? Here are some actions I recommend:

- Destroy your debt! The number-one thing you can do to prep for economic winter is to get out of debt. As hard as doing so might seem now, it’ll seem even more difficult during a recession — or a depression. Start a debt snowball. Do your best to grow it every month. It was a vast relief for me to not be in debt during the last economic downturn. It made everything easier to handle.

- Bolster your emergency fund. If you’re in debt (or new to saving and investing), this step is especially important. The time to build your emergency fund is before you need it. Build it now, when times are flush. Don’t worry about finding the perfect bank account. Pick a savings account that’s easy for you to access, and start setting money aside. If you’re just starting out, aim to set aside $1000 (and make this your top priority before anything else). If you already have some saved, save more. Most experts recommend setting aside enough to cover three to six months of expenses. Think of it as insurance in case you lose your job — or worse.

- Balance your budget. When things are humming along smoothly, it’s all too easy to succumb to lifestyle inflation. You have more, so you spend more. But during economic autumn, you ought to review everything you’re spending to make sure your budget is aligned with your values. Aim for big wins first. Do what you can to reduce how much you’re spending on housing and transportation before tackling smaller expenses.

- Double-down at work. With unemployment relatively low, employers are eager to find quality employees. This might make it tempting to switch jobs. Think carefully before making the leap, however. If we do experience an economic downturn in the near future, new employees will be at greater risk for losing their positions. It might make more sense to double-down on your current job, making yourself even more valuable to your employer.

- Make sure your asset allocation matches your risk tolerance. This step is crucial, especially for folks who are heavily invested in the stock market (like me). A decade ago, you might have decided that based on your risk profile, you ought have 60% of your retirement in stock and 40% in bonds. Well, if you haven’t made any adjustments lately, those numbers are likely to be way out of line. Economic autumn is the time to get these back to where they should be. (Unsure of your risk tolerance? Take the free Vanguard investor questionnaire to discover a suggested asset allocation.)

Basically, there are two keys to preparing for a recession: Beef up your cash reserves while reducing your ongoing expenses. All my specific recommendations support these two actions.

Based on this core concept, you can make appropriate adjustments for particular situation. You might, for instance, think twice before buying a home. It can be risky to buy a bigger home (and take on a bigger house payment) heading into an economic downturn. Your expenses go up just as your ability to pay takes on greater risk.

Now, I want to be clear: There’s no way to know for sure that we’re headed for dark days in the economy. Maybe things will stay rosy for another five or ten years. If so, awesome! If that’s the case, then having made preparations for a downturn won’t hurt you at all. (In fact, they’ll put you in a position to make more money during flush times.)

But history tells us that bad times always come — and they tend to follow predictable cycles. Nobody can know for sure when the next economic winter will arrive, but one thing is for sure: Winter is coming. And you want to be ready when it arrives.

The post Winter is coming! How to prepare for the next recession BEFORE it arrives appeared first on Get Rich Slowly.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment