I want to apologize for yesterday’s email.

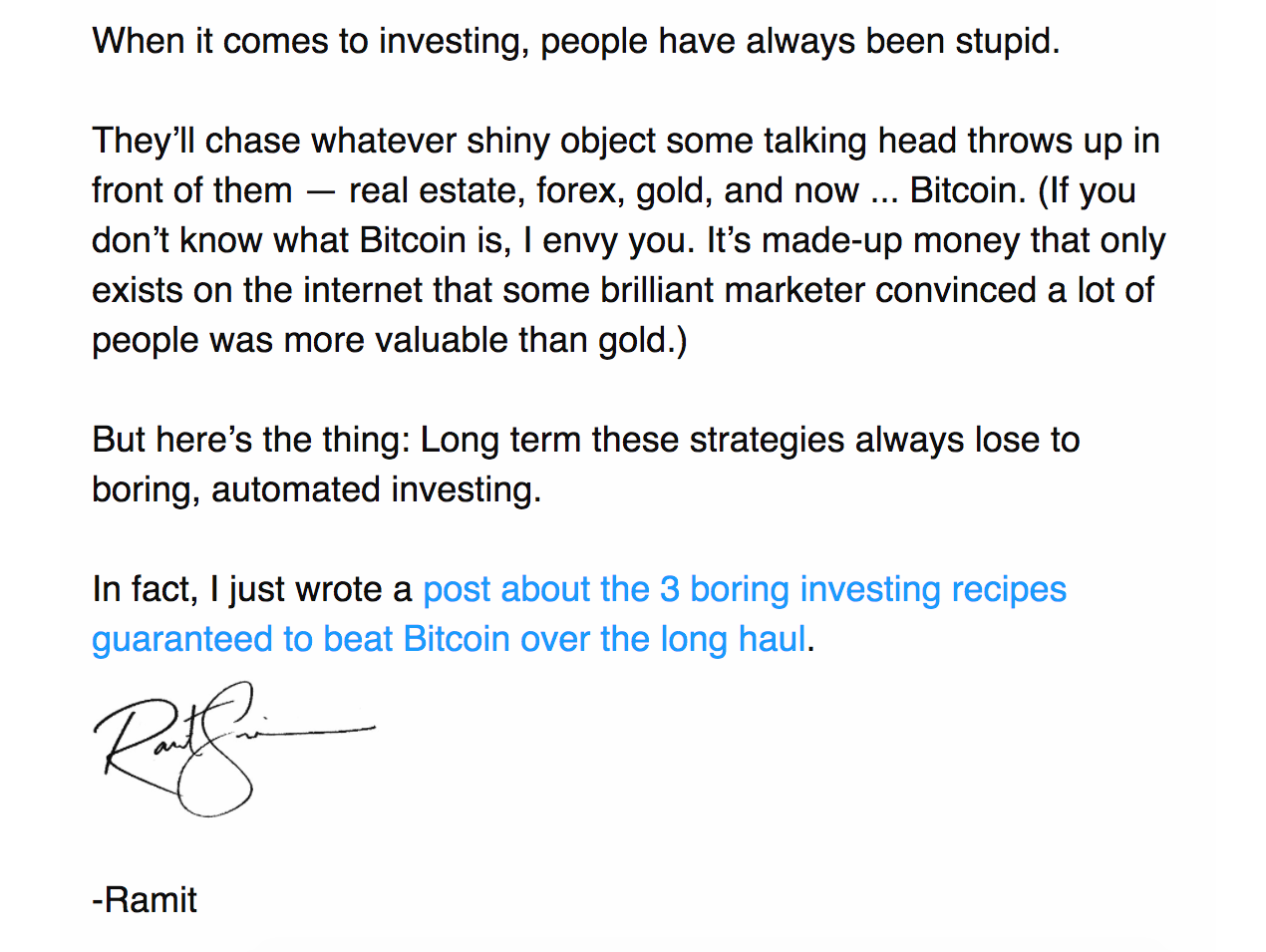

If you’re subscribed to I Will Teach You To Be Rich, you received this email yesterday.

I see a lot of things wrong in that email.

- “Guaranteed to beat.” (no, nothing is guaranteed in investing)

- “People have always been stupid.” (why is this even here?)

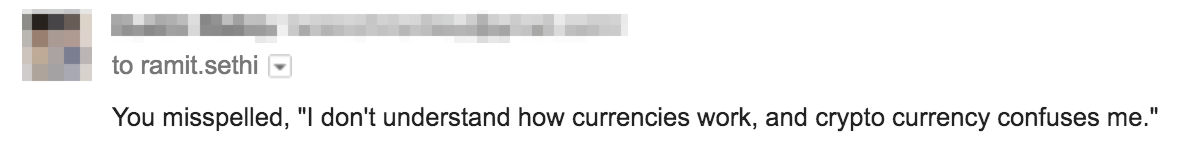

- “Made-up money that only exists on the internet” (all currency is made up…so what?)

Why did we send such an inflammatory email? One that doesn’t even represent what I really think about Bitcoin?

I want to explain how this happened, my actual views on Bitcoin, and finally what we’re doing about this.

First, my comments on yesterday’s email.

- It was unnecessarily dismissive of Bitcoin, which has had a major impact on money, technology, and culture in the last few years.

- It was over-sensationalistic and clickbait-y.

- It didn’t sound like us.

- It had nothing to do with the post it was linking to.

- It was not aligned with my view on Bitcoin.

In a world of hype, I believe in cutting the B.S. and being honest with you, and this email failed.

That No-B.S. view is why I don’t allow anyone with credit card debt to join our flagship courses, which costs us millions of dollars a year. One of our core values is “No B.S.” (it’s why that phrase is even on the cover of my NYT best-selling book). So when we’re guilty of it, we need to recognize it and apologize publicly. Yesterday’s email was B.S. We messed up. And we 100% deserve the heat from it.

Plus the tons of responses on Twitter (you can see them using this search).

It’s no wonder that when we sent an email like yesterday’s, people were mad. I don’t blame them.

How this email went out

We have a team of dozens of people at IWT. While IWT started with just me writing, now we have teams of engineers, product developers, and writers. My goal is to share my views with our team, and together, we share them with the world. I do everything I can to empower my staff to create great material. We talk often about our company values, the ways we can push our students to think bigger, and the fun approaches we can use to help our readers live their Rich Lives.

In an effort to push the envelope, we got aggressive and got away from the things that made us who we are. We tried to take a hot topic (Bitcoin) to get you to click on a not-as-hot topic (lazy portfolios). There was no reason to do that. It didn’t add to anyone’s understanding of either topic. We should have led with quality and creativity and let the quality of the blog post stand on its own. We don’t need to resort to clickbait tricks.

Here’s a note from our Editor in Chief. But as CEO, it’s ultimately my responsibility.

Whenever a friend and I have a disagreement, we sit down and hash it out over some buffalo wings. So let’s clear the air. I’m going to share my thoughts on Bitcoin. You might agree or disagree, but you deserve to hear it straight.

A few starting points:

- Money is a small, but important part of a Rich Life. I believe money is important, but there’s more to a Rich Life than a big bank account. I share this because money is important — but that’s not the sole thing that guides me, or our readers.

- Investing is one of the most powerful ways to grow your assets. I’m no stranger to investing — I’ve invested millions of dollars, and I believe in investing your money and investing in your intellectual capital through books, training, conferences, and more.

- Here’s where I invest my money. I invest primarily in passive investments — index funds — and I have a few individual stocks and angel investments. This is exactly what I recommend in my book on personal finance. I could make millions of dollars recommending terrible investments to my readers with fat commission fees…but I will never do that.

“Do you believe in Bitcoin technology?”

- Yes, I believe in Bitcoin technology. We only have to look at the major impact Bitcoin has had to know that the technology is real. Beyond that, I don’t have a strong opinion on the tech. I have strong beliefs about Bitcoin as an investment — but as for the technology, I respect the technical innovations that are happening in fintech as a result of Bitcoin.

- I’m critical of Bitcoin when viewed through the lens of asset allocation and personal finance. When I talk about Bitcoin, I’m not evaluating it as a technology. (See my above comment.) I’m critical of it when I see people investing all their money into Bitcoin.

“Do you believe Bitcoin is a good investment?”

- Maybe. Undoubtedly, it’s beat all other asset classes in the last two years. However, I’m personally not investing in Bitcoin.

“So what is your problem with Bitcoin?”

- Nothing, if you treat it as an investment in your portfolio. If anyone wants to invest 5% or 10% of their portfolio, great! In my personal finance book, I specifically encourage people to set their portfolios up, and if they want to invest a small percentage in fun investments, go for it.

- But when people put all their money in one investment, that’s not investing — that’s speculation.

- The language around Bitcoin is filled with hype and handwavy arguments. As the price of Bitcoin gets higher and higher, the language used to talk about it becomes increasingly frantic and frenetic. The fundamentals of the investment (which nobody understands) become cloudier and focused purely on the price. If you look at Bitcoin investment communities, a huge percentage of the comments are simply people encouraging others to “HODL” (the community’s word for “HODLing” onto crypto for the long term) and get other people to buy more. There’s little recognition of how Bitcoin fits into an overall portfolio.

- Your asset allocation matters more than any individual investment. This core investing concept is something I rarely see in the Bitcoin community, along with the core investing concept of risk. (Note: I’m using the term “risk” as the technical investment definition, not just “Can I withstand this going down 30% for a few days?”) Nobody needs to talk about asset allocation while the price of a single investment is skyrocketing…until it isn’t. I’ve had people call me “old man” and “Luddite” for not putting my entire portfolio into Bitcoin. That’s not sound portfolio strategy. There’s a reason why every sophisticated investor understands the power of diversification and asset allocation.

“But Bitcoin has beat everything else.”

- True. But higher prices create lots of accidental geniuses. The higher the price goes, the more people think they’re geniuses. It’s easy to handwave against all arguments and simply say, “LOL! Look how much money I’ve made!” That sort of argument can seem like a mic drop. Until it stops working. When I’ve asked some Bitcoin investors how they think about their overall portfolio, diversification, asset allocation, a few have had good answers. Most have no answer at all. They simply say, “Dude, look how much money I’ve made.” Again, that’s not investing. That’s speculation. History has shown that long-term investing is more than picking one investment, no matter how high it goes.

“Are you just bitter that you missed out?”

- No, I’m intentional about my investments. I’m not bitter that I “missed out” on Bitcoin as an investment (nor should you ever invest based on “missing out”). Again, if you’re investing 5-10% of your portfolio in speculative or fun investments, great.

- I don’t mind if you disagree with me. I’ve taken heat for my views on real estate before. Same for my negotiation techniques. But millions of people read them, many used them, and we had vigorous debates. I don’t mind if you disagree with me, but we should have an honest discussion, not use cheap tricks and insults (like our above email). Investing is fun but it’s also serious, and it involves a lot of nuances. I want to have that kind of discussion with you.

So, to sum up:

- I’m sorry for yesterday’s email and I take responsibility for it. In 13 years, this is the second apology note I’ve written. That email didn’t reflect my views or our values as a company.

- We’re making internal changes to ensure that all of our material reflects our values. I know you have a lot of choices, and you read our material because you want to know surprising, counterintuitive, but data-backed methods to living a Rich Life. We’ve written about personal finance, business, psychology, careers, and more. And we’re going to keep at it.

- Thank you for trusting me and our team with your attention. We’ve got much more coming your way.

-Ramit

P.S. Now it’s time for me to stop talking and start listening. I’d love to hear from you. Do you agree? Disagree? I’m leaving comments open for the next week and I want to hear what you’d like to tell me about Bitcoin. What should I be paying attention to? How has Bitcoin changed the way you think about investing? Please let me know.

We messed up. An apology from Ramit is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment