Getting out of debt is tough for a lot of people. It’s both a financial and psychological challenge. Think of it this way: Getting out of debt when you haven’t learned how to manage money is like running a marathon without preparing physically. Both tasks are possible, but they’re much more difficult than they would be for someone who was actually prepared.

This is why many folks need to use psychological “tricks” when they repay their debt.

For example, I’m one of many who used the Dave Ramsey version of the debt snowball to finally achieve debt freedom. I tried (and failed) to use the mathematically optimal method — repay your high-interest debts first — several times. Once I shifted my focus to repaying low-balance debts first, I was able to plow through my debt without a problem.

Another game people play when paying off debt is the use of visualizations. Take Alissa, for instance, the GRS reader who created a paper chain to represent her debt. Each link in the chain represented $100. Whenever she made a payment, she got to cut off a few links — until the chain was gone.

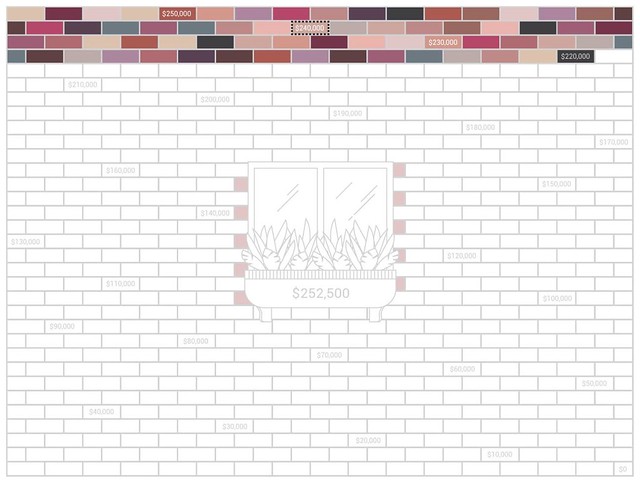

This morning, Kitty from Bitches Get Riches shared a similar way to visualize debt:

This is the debt visualization I use today. It’s a brick wall representing my post-down payment mortgage debt of $252,500. Each brick represents one thousand dollars. I color one in for every $1,000 I pay down toward the principal. If you look closely, you’ll see one brick with a dotted black outline. That’s where I would be today if I only made minimum payments.

Although these sorts of visualizations and psychological tricks are most commonly used when getting out of debt, the same concepts can also be applied when building your wealth snowball.

What methods have you used to visualize your progress toward your financial goals?

The post Visualizing your financial progress appeared first on Get Rich Slowly.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment