I want to tell you the story of two people: Andrew and Mary.

Both are 21, fresh out of college, and have the same jobs in the same industry.

When it comes to investing, though, Mary decides to start putting money into a diversified portfolio of mutual funds. It’s not a lot at first, but over time she puts more money into her funds as she earns more.

Andrew, on the other hand, buys a few individual stocks after watching The Wolf of Wall Street — but sells them as soon as prices dip a little.

Occasionally, he puts away an arbitrary amount of money in a savings account and doesn’t seriously start investing until he’s in his 50s.

Fast forward 40-ish years. The two are now closing in on retirement age. However, their financial situation couldn’t look more different.

Mary is well off. She has a sizeable nest egg due to her decision to invest when she was 21, and doesn’t have to worry about money when she decides to retire soon.

Andrew didn’t start investing until long after Mary started. As a result, he has to consider forgoing retirement while he saves up enough money. This makes him a crotchety old man and he spends his days shouting at children and small animals who venture onto his lawn.

Okay, that’s a little dramatic — but there’s something to learn here. On paper, Andrew and Mary seemed to be on the same path. Same age. Same education level. Same job. So what was the difference between them that set them on completely separate financial situations?

Simple: Mary was a couch potato.

What’s couch potato investing?

I love index funds.

I love them so much I’m going to name my firstborn son “Index Fund Sethi” and his mother will hate me. And one of the best ways I’ve found to leverage index funds is by building a lazy portfolio.

I’ve talked about them before, but to recap, a lazy portfolio is a diversified portfolio of low-cost index funds that allows you to be hands-off with your investing. That means no active trading, no checking your stocks every day, and no paying some hedge fund manager (who won’t beat the market anyway) to handle your money.

Couch potato investing simply refers to investing in a lazy portfolio — more specifically, a specific lazy portfolio “recipe.”

These “recipes” are formulas for different combinations of funds and bonds that investors can base their portfolios on.

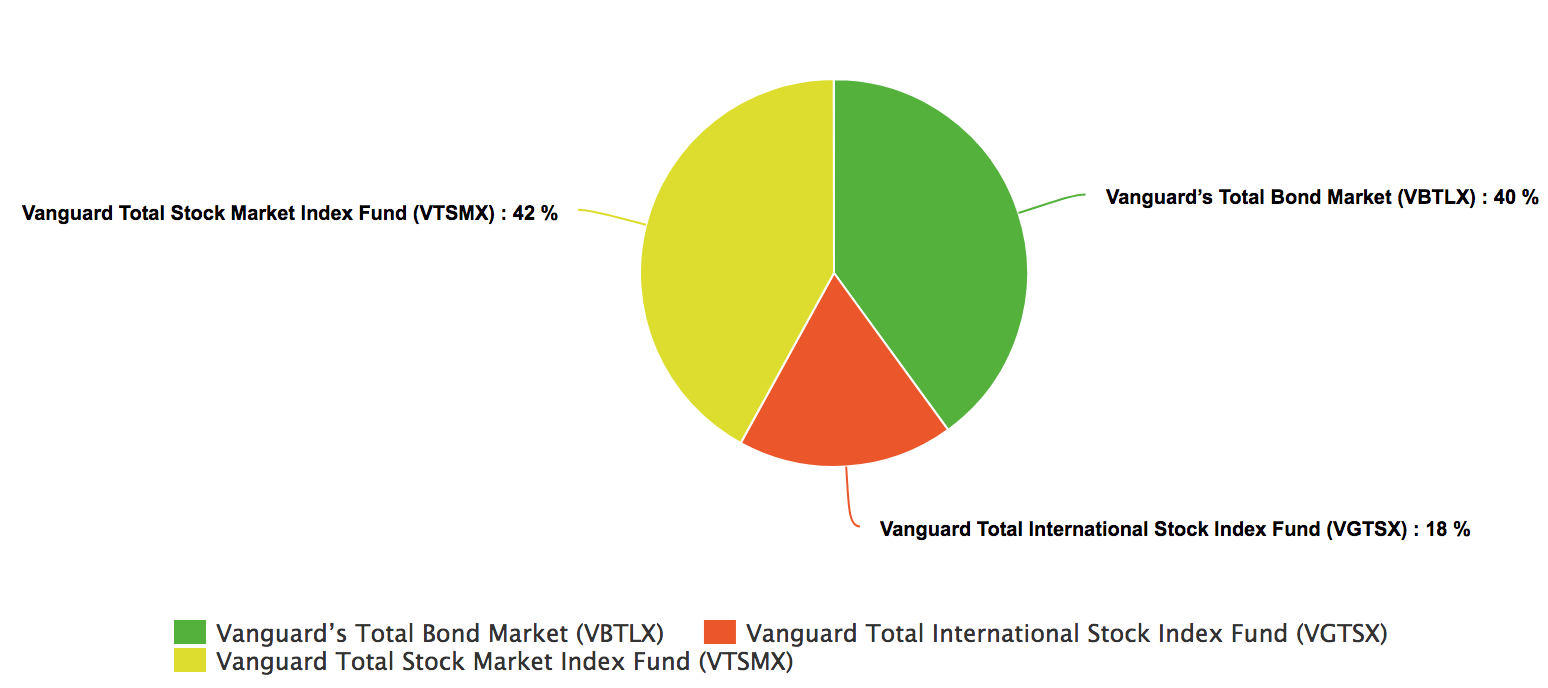

For example, last week we talked about a lazy portfolio recipe from Taylor Larimore. His portfolio suggests you split up your asset allocation so it’s 42% U.S. stocks, 18% international stocks, and 40% bonds.

As a result, your portfolio would look like this:

However, the couch potato portfolio is actually simpler. Here’s why:

Scott Burns’ Couch Potato Investing Strategy

Personal finance writer and co-founder of AssetBuilder.com Scott Burns developed the Couch Potato Investing Strategy in 1991 as an alternative for his readers, who were paying money managers to handle their investments.

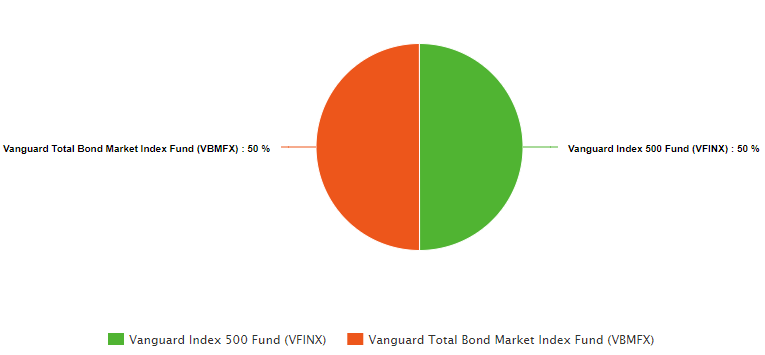

The recipe is INCREDIBLY simple:

- 50% in total stock market fund (like S&P 500)

- 50% in total bond market fund (a fund made of many different bonds)

And voila! You have your couch potato investing portfolio.

Burns also suggests these two funds that correlate with those asset classes:

Really complex. I know.

Of course, you don’t have to stick to the above fund recommendations. Most brokers such as Schwab and T. Rowe Price offer comparable funds such as Schwab’s S&P 500 Index Fund (SWPPX) and T. Rowe Price’s Equity Index 500 Fund (PREIX).

Burns also suggests you utilize strategic asset allocation and rebalance your portfolio each year so that you always have an even split of bonds and stocks.

“This doesn’t look diversified at all!” you may be saying. “There are only two funds in this portfolio.”

This is the beauty of index funds like the S&P 500 — they ARE diversified because they invest in 500 different companies. This means they’re much less volatile.

Sure, you’re going to see returns come in slowly. But if you keep your cash in the market over time, history shows that you’re VERY likely to make money.

How likely? Over 40 years, the Couch Potato Investing Portfolio earned an average of 9.78% annually — a number the vast majority of money managers fail to beat.

“I want my own couch potato portfolio! How do I start?”

Luckily, there are a TON of reputable brokers out there who can help you start investing.

Unluckily, there are a TON of shady brokers who are only out there to take your money.

Luckily, I have a list of awesome, trusted brokers you can reach out to today to get your own couch potato portfolio.

My suggestions:

- Vanguard (This is the one I use)

- Phone #: 877-662-7447

- T. Rowe Price

- Phone #: 800-225-5132

- TIAA

- Phone #: 800-842-2252

- Charles Schwab

- Phone #: 800-435-4000

Signing up is ludicrously easy too:

- Step 1: Go to the website for the brokerage of your choice.

- Step 2: Click on the “Open an account” button. Each of the above websites has one.

- Step 3: Start an application for an “Individual brokerage account.”

- Step 4: Enter information about yourself — name, address, birth date, employer info, social security.

- Step 5: Set up an initial deposit by entering in your bank information. Some brokers require you to make a minimum deposit, so use a separate bank account in order to deposit money into the brokerage account.

- Step 6: Wait. The initial transfer will take anywhere from 3 to 7 days to complete. After that, you’ll get a notification via email or phone call telling you you’re ready to invest.

- Step 7: Log in to your brokerage account and start investing 50% in total stock market fund and 50% in total bond market fund. If you want to follow Scott Burns’ recommendations, purchase these funds: VFINX and VBMFX.

NOTE: The wording and order of the steps will vary from broker to broker but the steps are essentially the same.

You’re also going to want to make sure you have your social security number, employer address, and bank info like account number and routing number available when you sign up, as they’ll come in handy during the application process.

The application process can be as quick as 15 minutes. In the same time it would take to watch this handsome weirdo give a talk on how much to charge your customers, you could set up a new brokerage account and start investing in your future.

If you have any questions about funds or trading, call up the numbers provided above. They’ll connect you with a fiduciary who works for the bank in order to give you the best advice and guidance they can.

Automate your investing from your couch

Let’s take this couch potato concept even further and automate your finances so you don’t have to worry about sending money into your portfolio each month.

If you want to find out more about how to automate your finances, check out my 12-minute video explaining it here:

If you’re relatively new to investing, I’m so happy you’re here. Simply by doing your research, you’re already ahead of 99.99% of people out there when it comes to planning for your financial future.

That’s why I want to offer you The Ultimate Guide to Personal Finance.

In it, you’ll learn how to:

- Master your 401k: Take advantage of free money offered to you by your company…and get rich while doing it.

- Manage Roth IRAs: Start saving for retirement in a worthwhile long-term investment account.

- Spend the money you have — guilt-free: By leveraging the systems in this book, you’ll learn exactly how you’ll be able to save money to spend without the guilt.

Enter your info below and get on your way to living a Rich Life today.

How to invest like a couch potato is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment