Investing can be incredibly intimidating to beginners. The subject is fraught with questions like:

“What stocks should I invest in?”

“How do I invest for retirement?”

“What the hell is a mutual fund anyway?”

And while there are many ways to approach your investments, technology has allowed people to streamline the process and take just a little bit of the headache away from it (*cough* like automating your finances *cough*).

Enter: micro investing. At its core, micro investing is investing small amounts of money into a portfolio. (For example, taking the change left over from a purchase and automatically placing it into a savings account.) This is typically done through an app that automates the entire process for you.

Today, I want to take a look at why these apps can be effective ways to save and share three you can download to get started.

What are micro investing apps?

Micro investing apps invest small amounts of money by connecting your debit card, credit card, or bank account to the app. In doing so, they bypass the fees you get when dealing with brokerage firms, allowing you to invest small amounts of money without breaking the bank.

Though the way the apps work varies, they usually use the money you spend on purchases to invest. Whenever you make a purchase with those cards or bank account, the app automatically rounds your purchase up to the nearest dollar and invests the difference for you.

For example, if you go out for dinner and end up spending $17.85, the app will round the purchase up to $18 and invest the $0.15 difference into a portfolio for you.

These are incredibly small amounts of money — less than a dollar — which might lead some of you to think this isn’t even worth pursuing (aka a latte win). However, if you invest early with any amount, that’s still a Big Win. Why? It’s also a habit that anyone can do that barely takes any work. You simply set it up once, and it pays off for years.

HOWEVER, micro investing should NOT be the foundation of your investment strategy. It’s more of the cherry on top. This is a good way to build upon things like putting money consistently into your Roth IRA and 401k (more on those later). Micro investing shouldn’t be the ONLY thing you do.

With that, I suggest three micro investing apps to help you get started today. They are:

Micro investing app #1: Acorns, the app for college students and beginners

Where to find it: Website, iOS, and Android

Fee: $1/month if your account is <$5,000, and 0.25% if your account is >$5,000

Account minimum: $0 to open, $5 to invest in portfolios

Acorns allows you to connect your debit or credit card to the app, and “rounds up” your purchase automatically. This rounded up money is then sent to a diversified portfolio of exchange-traded funds, or ETFs (a collection of various stocks in a specific industry or category), which vary depending on your aversion to risk.

The app also gives you a suggestion for portfolios based on questions it asks you when you sign up (age, income, financial goals, etc). For example, if you’re a young, twentysomething, it’s probably going to suggest you go with their more aggressive portfolio as opposed to a conservative one since you’re young and can take more risks.

In all, they offer five portfolio options:

- Conservative. Big focus on corporate and government bonds, as those present less of a risk.

- Moderately conservative. 60% of the portfolio is made up of bonds but you get a little bit more stocks as well.

- Moderate. Even mix of stocks and bonds.

- Moderately aggressive. Bigger focus on large company stocks with just 20% of the portfolio placed in government and corporate bonds.

- Aggressive. 80% of this portfolio is made up of various stocks while just 20% is bonds.

You’re going to have to put up $5 to start investing in these portfolios. So despite it costing nothing to open the account, you’re still going to have to put up a little bit of money to invest with Acorns.

Though the asset allocation varies from portfolio to portfolio, the specific funds your money gets invested in are as follows:

- Corporate bonds: iShares iBoxx$ Investment Grade Corporate Bond ETF (LQD)

- Government bonds: iShares 1-3 Year Treasury Bond ETF (SHY)

- Large company stocks: Vanguard S&P 500 ETF (VOO)

- Small company stocks: Vanguard Small-Cap ETF (VB)

- Emerging markets: Vanguard FTSE Emerging Markets ETF (VWO)

- Real estate: Vanguard REIT ETF (VNQ)

The app is also primarily targeted at younger investors (it’s actually free for four years if you sign up with a .edu email address), and presents a good “dip your toes in investments” option for college students who are nervous about getting started.

Bottom line: It’s a simple, straight-forward app that’s just right for any college student looking to get involved in investing but doesn’t want to put a lot into it right away.

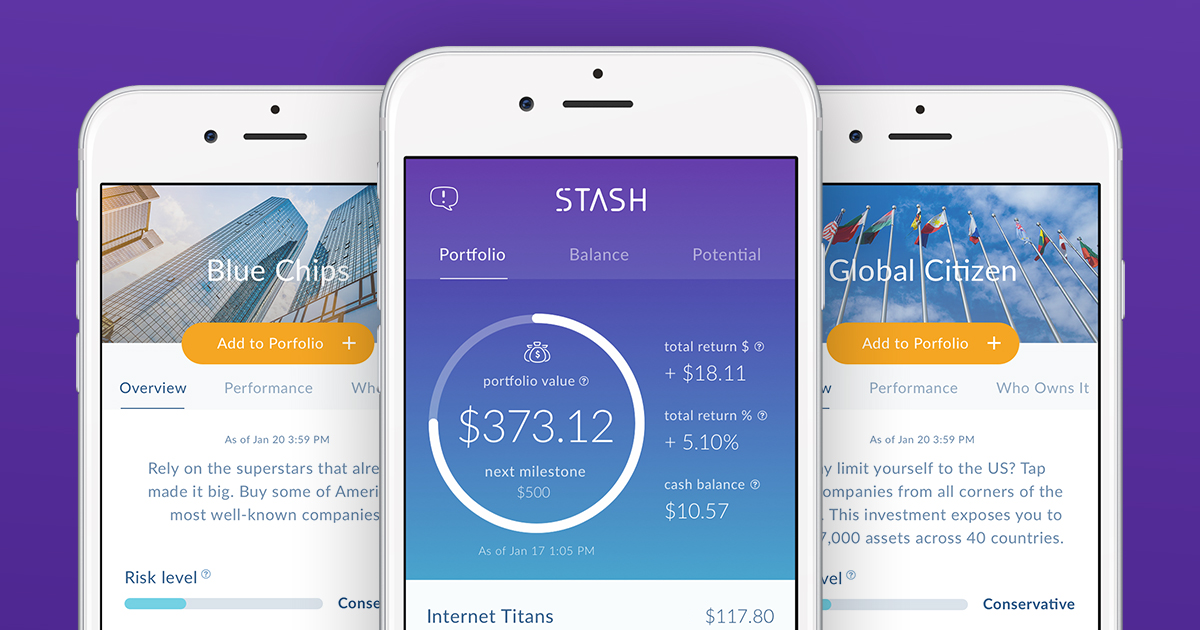

Micro investing app #2: Stash Invest, the app for hands-on beginners

Where to find it: Website, iOS, and Android

Fee: $1/month if your account is <$5,000, and 0.25% if your account is >$5,000

Account minimum: $5

Stash works much in the same way Acorns does by leveraging your purchases to invest small amounts into a portfolio of ETFs. However, it offers a few interesting features that give investors a bit more variety in where they put their money.

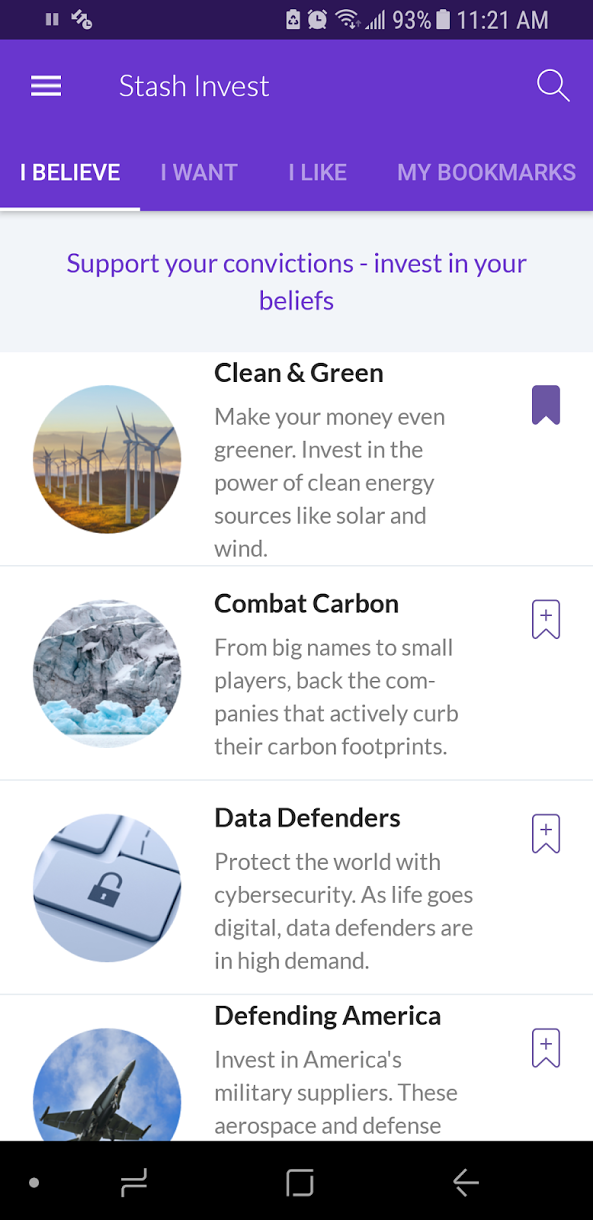

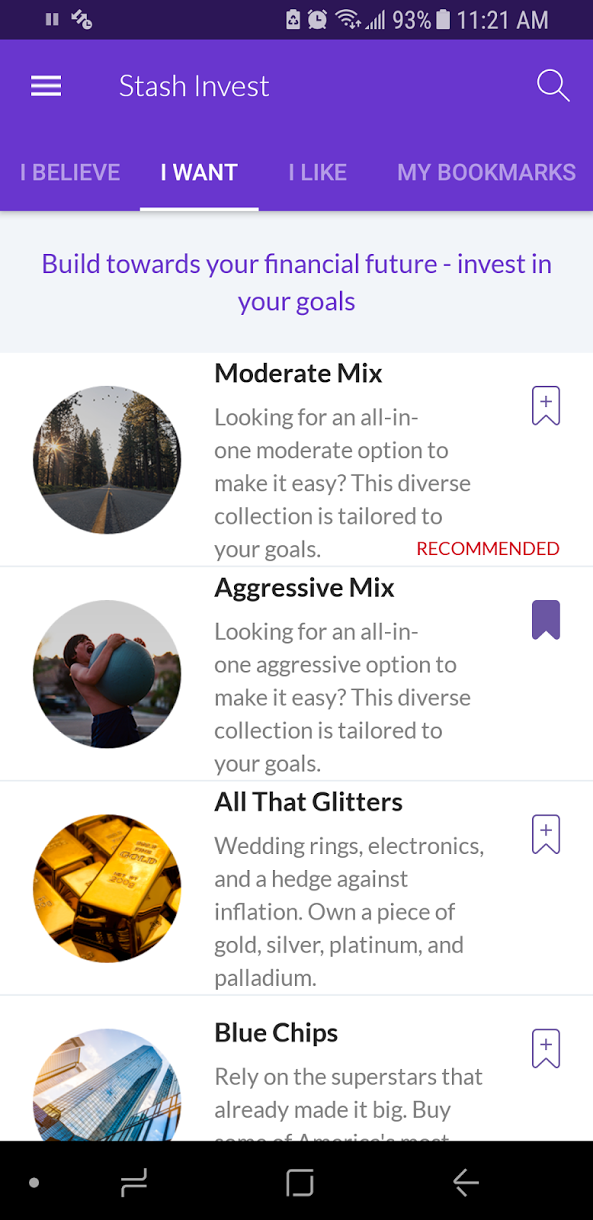

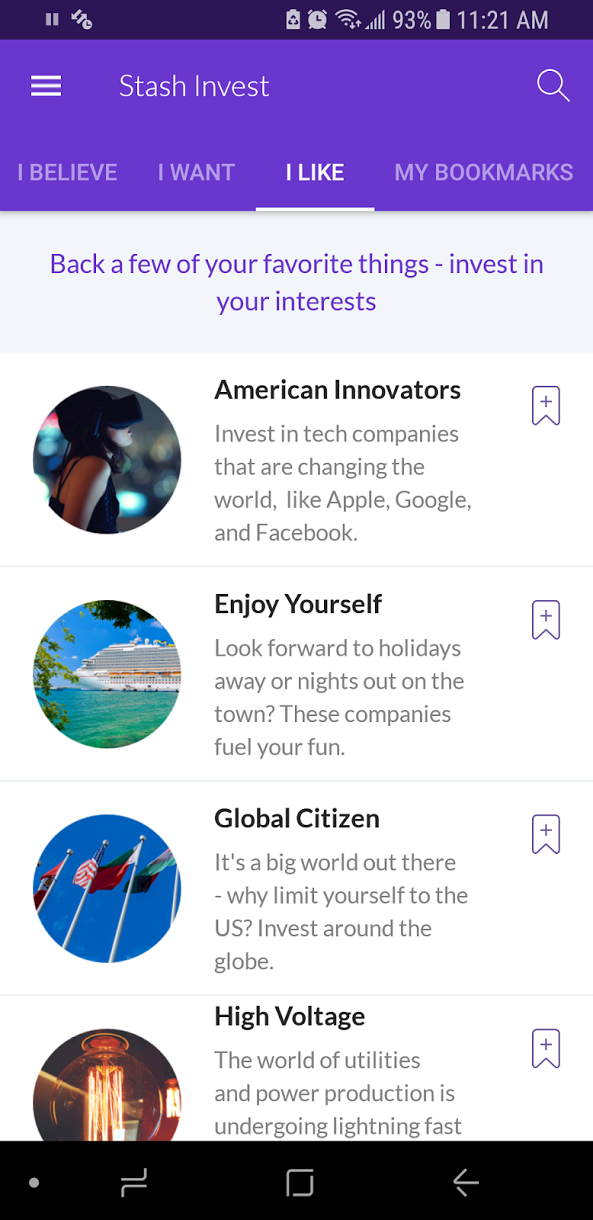

Rather than having only five choices to put your money, Stash gives you the opportunity to invest in more purposeful funds.

These funds are divided up into three categories:

- I Believe. These funds help you invest your money in companies that champion social and environmental causes. For example, you can invest your money in a fund they call “Combat Carbon,” which puts your money in a fund with companies with “relatively small carbon footprints.” (iShares MSCI ACWI Low Carbon Target ETF)

- I Want. These funds are crafted with your financial goals in mind. If you find yourself risk averse, you can invest in their “Conservative Mix” fund (iShare Core Conservative Allocation ETF). On the other side of the coin, you can invest in their “Aggressive Mix” fund (iShare Core Growth Allocation ETF) if you want to invest more…well, aggressively.

- I Like. These funds help you invest in the companies that you simply admire. Do you like tech innovators? Invest in their “American Innovators” fund (Vanguard Information Technology ETF). Love shopping? Check out their “Retail Therapy” fund (SPDR S&P Retail ETF).

You can mix and match your funds to create a portfolio that suits your goals. It’s a little bit more hands-on in terms of asset allocation than Acorns, but if you’re the type of person who likes to be more involved in what you’re investing in but still likes using your purchases to invest, then Stash is perfect for you.

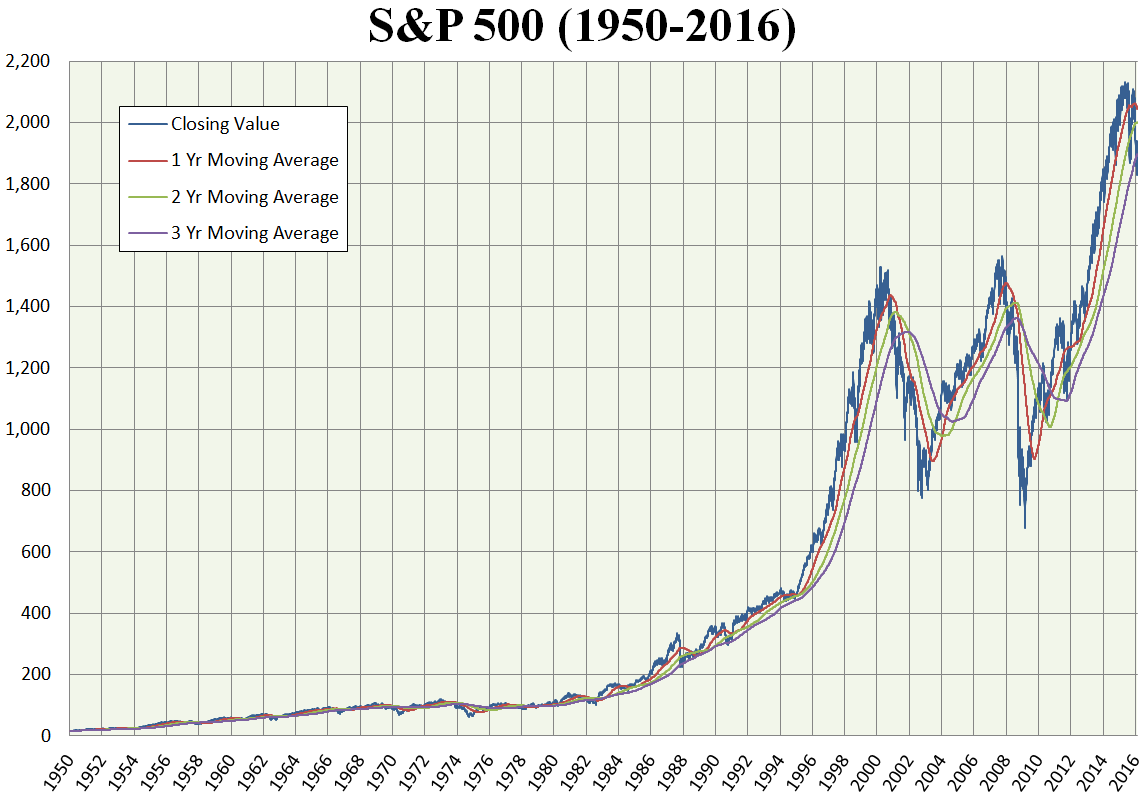

It’s important to note that you’ll be investing in index funds — which means your investments will be relatively safe. Take a look at the graph below.

Does that look like a crazy volatile investment to you? No. Which is why you shouldn’t worry about these investments tanking in the long run.

Bottom line: Stash is great for beginners who want to dip their toes into the world of picking and choosing their own funds without having to make a huge commitment.

Micro investing app #3: Robinhood, the app for experienced investors

Where to find it: iOS and Android

Fee: $0

Account minimum: $0

You know what Jared Leto, Snoop Lion Dogg, and Nas have in common? Aside from the ludicrous amounts of wealth and fame they’ve amassed, the three have all invested in Robinhood — a stock trading app that bypasses big bank brokers like Fidelity or E*TRADE and allows you to purchase funds directly (without the costs!).

You’ll be able to buy and trade a wide variety of stock and fund options without having to pay some “money manager” a fee. It’s great for people who love to be more hands-on with their portfolio, asset options, and where their money goes.

You can also automate money to go into your portfolio on a weekly, monthly, bi-monthly, and quarterly basis (remember: automation is king).

However, this app doesn’t work the same way as Stash or Acorns. Instead of investing money through your purchases, Robinhood requires that you transfer funds directly into the app in order to invest it. So rather than taking your extra purchase money, Robinhood requires you automatically wire money from your bank account each month. I suggest starting with $5.

It’s more hands-on than the other two, but you’ll still be able to save money by avoiding the fees that come with normal brokers while automating small amounts into the app.

Bottom line: This app is a solid choice for more experienced investors who want to be more hands-on with their portfolio.

The best investments tools at your disposal

Remember: Micro investing is not a good foundation for your investments.

It can be a good way to supplement your investments, especially when you automate the process and don’t have to think about it. But you don’t want it to be the only way you invest.

Instead, I suggest that you put money into two retirement accounts that’ll help you save for the future:

- 401k. This is essentially free money from your employer. With each pay period, you put part of your pre-tax pay into this account. Typically, your company will match you 1:1 up to a certain percentage of your paycheck. By leveraging your pre-tax contributions with compounding interest, you get a powerful combination.

- Roth IRA. This is the best deal for long-term investing. This account utilizes after-tax earnings to help you save long term for retirement. You put this already taxed income into funds and don’t pay a single cent when you withdraw it.

Both these accounts have different restrictions on how much you can invest per year and the types of funds you can invest within them. For more information on them, check out my resources below for them:

- 4 keys to early retirement

- How do retirement accounts work?

- Should you contribute to your 401k without an employer match?

How to find money for micro investing

If you’re worried you don’t even have enough money to spend on lunch today let alone investing in a diversified portfolio, don’t worry because I have something for you: A FREE chapter of my New York Times bestselling book I Will Teach You To Be Rich.

In this chapter, I lay out my Conscious Spending Plan system. This is a system that allows you to know exactly how much you can spend each and every month, so you’re not constantly wondering how much you have.

This will help you invest and spend guilt-free every day.

Enter your information below now to receive the free PDF today.

An introduction to micro investing: 3 ways to get started is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment