Last week, I wrote about strategic asset allocation.

That’s when you maintain a fixed allocation percentage for your asset classes and rebalance those assets every year. It’s the set-it-and-forget-it approach to your portfolio.

Today, I want to talk to you about its more rebellious sibling: tactical asset allocation.

Tactical asset allocation is the practice of actively managing your portfolio and changing the amount you hold in each asset class based on how the market is performing.

To get a better understanding, let’s take a deeper look at how exactly asset allocation works and why tactical asset allocation might be a good fit for you.

What is asset allocation?

You can allocate these investments into “asset classes.” The major ones are:

- Stocks. Otherwise known as equities. When you own a company’s stock, you own part of that company.

- Bonds. These are like IOUs that you get from banks. You’re lending them money in exchange for interest over a fixed amount of time.

- Cash. This includes physical money and the money that you have in your checking and savings accounts.

In short, asset allocation is just a fancy way of describing where you put your money. When you set up a strategic asset allocation plan, you decide on a goal of how much money you want to have in each asset class.

Confused? Don’t be. It’s a seemingly complex term. Sometimes I use the phrase “asset allocation” at cocktail parties to sound smart. The host, whose party I am crashing, usually looks at me, surprised, and asks me one question: “How did you get in here?” But is soon so charmed by my weirdness that I’m allowed to stay.

Aside from a phrase I use to alienate people, asset allocation is also an investing method based on a 1991 study by researchers Gary P. Brinson, Brian D. Singer, and Gilbert L. Beebower. They discovered that 91.5% of the results from long-term portfolio performance in pension plans came from the investments that were allocated.

How tactical asset allocation works

Tactical asset allocation also requires you to set up a fixed goal percentage for each of your asset classes (e.g., stocks, bonds, cash) and keep those asset classes within that goal over many years. And if you stopped there, it would be “strategic asset allocation.”

But tactical asset allocation requires you to constantly adjust your holdings in the short term.

Let’s take a look at an example:

Imagine you’re a 30-year-old who has her portfolio set up as such:

- Stocks: 70%

- Bonds: 20%

- Cash: 10%

This is your base strategic asset allocation, or the ratio you want to keep your portfolio balanced for many years.

However, you recently found evidence that suggests that your stocks might see even more returns in the next year. So you rebalance your portfolio to take advantage of it:

- Stocks: 80%

- Bonds: 15%

- Cash: 5%

If your research is correct, you’ll see even more returns since you’re investing more in your stocks.

Eventually, you’re going to want to rebalance the portfolio when the market reverts back to its original performance to keep in line with your goals. This is a short-term strategy used to complement your strategic asset allocation.

So that’s how tactical asset allocation works…but is it right for you?

Who is tactical asset allocation good for?

Tactical asset allocation might be appealing if you:

- Don’t mind the risk. By responding to the market in the short term, you might find that your investments don’t perform well at all. If that happens, you’ll lose money.

- Are disciplined. Tactical asset allocation is building off of your long-term goals. That means once your short-term investments have or haven’t paid off, you need to revert back to your original strategic asset allocation.

- Want a more active role in your investments. Maybe you just want to be more hands-on with your investments. Maybe long-term investing is a little too boring for you (pro tip: It can never be “too boring”). In that case, tactical asset allocation gives you some of both worlds.

However, long-time IWT readers know that I don’t suggest you try and time the market.

Why? Simple: You’re probably going to get it wrong.

A 2017 study by the Center for Retirement Research at Boston College found that people who diverged from their target date fund investments in order to try to time the market underperformed those who just left their funds alone.

And here’s another one: The CXO Advisory Group, a firm of financial consultants with over 20 years’ experience, collected data from 2005 to 2012 and discovered that pundits and other market forecasters were only right roughly 48% of the time.

What does this all mean? You can’t predict market — at least in the short term.

The long term is another story.

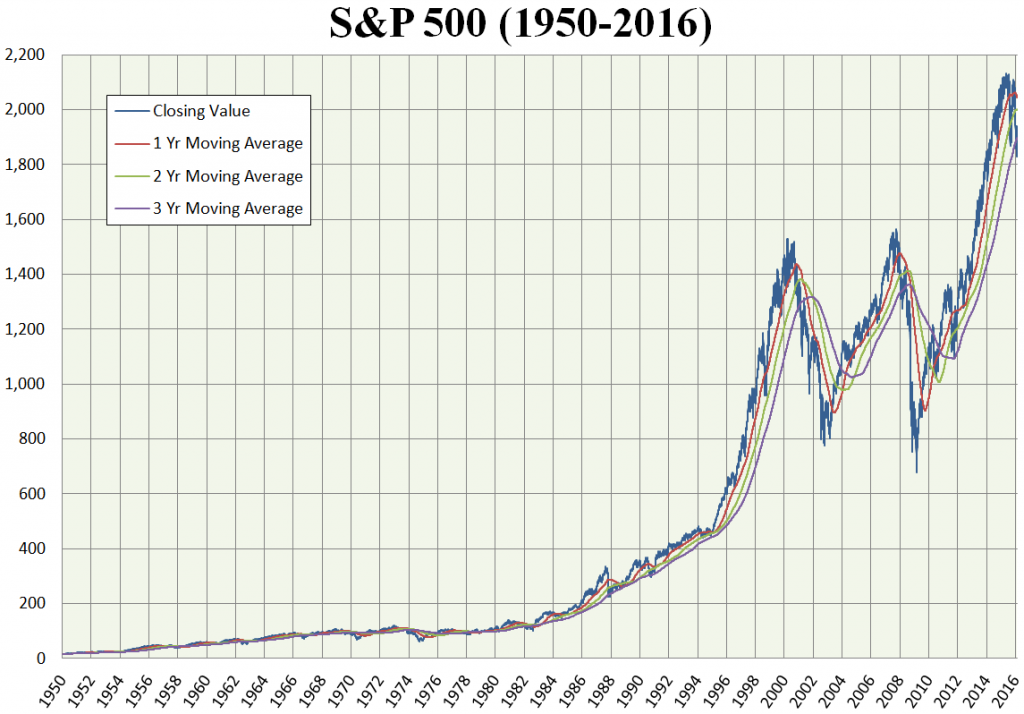

Check out my favorite graph in the whole world.

Only the coolest people have favorite graphs.

Though there might be changes in the short term, the market trends up over a long period of time.

This fact should drive your investment decisions. Not the pundits telling you that XYZ stock is performing really well or your hunch that a certain industry is going to explode.

That’s why I suggest you invest a diversified portfolio of low-cost index funds and leave your assets alone.

However, even with strategic asset allocation, you’re going to have to rebalance once a year or so to prevent one asset from getting too large or small. (This protects you from being vulnerable to the ups and downs of a specific asset class.)

Often times though, people simply don’t rebalance their portfolios. The reason is twofold:

- People want more $$$. Why the heck would you take money out of one asset class that is performing really well and put it in one that isn’t performing nearly as well?

- People are lazy. Rebalancing portfolios isn’t exactly on top of everyone’s list of things they really want to do. So we put it off or just forget to do it altogether.

So how can you get the benefit of asset allocation without the constant maintenance? Choose funds that do the rebalancing for you.

Automate your portfolio with target date funds

I wrote about this in my article on strategic asset allocation, but it’s worth mentioning again: Target date funds (or lifecycle funds) are great funds for people who don’t want to worry about rebalancing their portfolio every year.

They work by diversifying your investments for you based on your age. And as you get older, target date funds automatically adjust your asset allocation for you.

Let’s look at an example:

If you plan to retire in about 30 years, a good target date fund for you might be the Vanguard Target Retirement 2050 Fund (VFIFX). The 2050 represents the year in which you’ll likely retire.

Since 2050 is still a ways away, this fund will contain more risky investment such as stocks. However, as it gets closer and closer to 2050 the fund will automatically adjust to contain safer investments such as bonds because you’re getting closer to retirement age.

These funds aren’t for everyone though. You might have a different level of risk or different goals.

However, they are designed for people who don’t want to mess around with rebalancing their portfolio at all. For you, the ease of use that comes with lifecycle funds might outweigh the loss of returns.

One thing you should note: Most lifecycle funds need between $1,000 to $3,000 to buy into them. If you don’t have that kind of money, don’t worry. I have something for you at the end that can help you get there.

To recap: No matter how motivated you are about investing right now, you will find other things more urgent and important later. We are all cognitive misers with limited cognition and willpower. Investing in a target date fund lets you compensate for your natural weaknesses and biases by automating complex asset allocation decisions.

For a more in-depth explanation, check out my video all about lifecycle funds.

Master your personal finances

Asset allocation isn’t hard.

What IS hard is getting started — which is why I’m happy you’re here.

If you’re interested in tactical asset allocation, chances are you already have a good idea of how you want to approach your investments.

However, if you want to earn MORE money so you can invest even more, I have something for you:

I’ve included my best strategies to:

- Create multiple income streams so you always have a consistent source of revenue.

- Start your own business and escape the 9-to-5 for good.

- Increase your income by thousands of dollars a year through side hustles like freelancing.

Download a FREE copy of the Ultimate Guide today by entering your name and email below and start earning more for your investments today.

All about tactical asset allocation is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment