I hope you’re ready. We’re about to discuss one of the hottest, most exciting investment topics out there.

No, I’m not talking about putting your money in Tesla.

And I’m not even talking about how awesome Bitcoin is (mostly because I’m not an annoying bro dude).

I’m talking about something even MORE exciting:

Strategic asset allocation is the practice of setting a goal for each of your asset classes (e.g., stocks, bonds, cash), and rebalancing it every year as you realize earnings on your investments.

This is a great tactic if you want to:

- Focus on long-term financial goals

- Enjoy a hands-off approach to your portfolio — and not wring your hands over how the market is performing

- Reduce your risk as an investor

Think of your investment portfolio as a garden: If you want your zucchini to be only 15% of your garden, and they start growing like crazy and take over 30%, you’ll want to rebalance by either cutting the zucchini back, or getting a bigger backyard so the zucchini is back to covering only 15%.

I know, I know. I should start I Will Teach You To Garden.

You’ll want to rebalance your portfolio every 12 to 18 months to ensure you’re getting the most out of your investments.

Let’s take a look at a non-gardening example:

Imagine you’re a 24-year-old who just opened up a brokerage account with $3,000. If you want to employ strategic asset allocation, you’ll want to set certain percentages you’ll want in each asset class based on your goals.

Since you’re young and have many years before retirement, you might be more willing to take risks with your portfolio. Considering this, you decide to be aggressive and put your money in 80% stocks ($2,400) and 20% bonds ($600).

A year later, you discover that your stocks accrued 20% from your initial investment, while your bonds have earned you just 2%. This leaves your assets at 82% stocks ($2,880) and 18% bonds ($612).

Now your assets are “unbalanced” in accordance with the goals you set for them and it’s time to rebalance them.

In order to stay in line with your strategic asset allocation strategy, you’ll need to take 2% or about $57.60 out of your stocks and into your bonds. That’ll leave your portfolio nice and balanced at 80% stock and 20% bonds once more.

Of course, your goals will change over time. As you get older, you’ll find that you might want to be more conservative with your investments, and you can change your asset allocation percentage so they fit your needs.

Why does this strategy work? Two reasons:

- No constant trading. That means you can just purchase your lifecycle funds (more on that in a bit) and let them ride the market for a year. There’s no constantly trading, worrying about BS commission costs, or dealing with hedge fund managers who’ll just lose your money anyway.

- Easy accommodation of your goals. If you find that you want to change how much you allocate in each asset class as the years go by, you can do that and it’ll be fine. These are your finances after all, and you get to decide what to do with them.

THAT’S strategic asset allocation.

How do I employ strategic asset allocation?

People always email me questions like, “Ramit, I have $XX,XXX. How should I invest it??” And, frankly, I can’t tell you that. Because it depends on your answer to a few specific questions…

“When do I need the money?”

If you need your money sooner (between two and three years from today), you might consider investing in a conservative portfolio. That’s because the market can be incredibly volatile in the short term.

On the other side of the coin, you might want to invest more aggressively if you’re saving money for retirement (assuming retirement is 10+ years away). Over a long period of time, the market trends upwards.

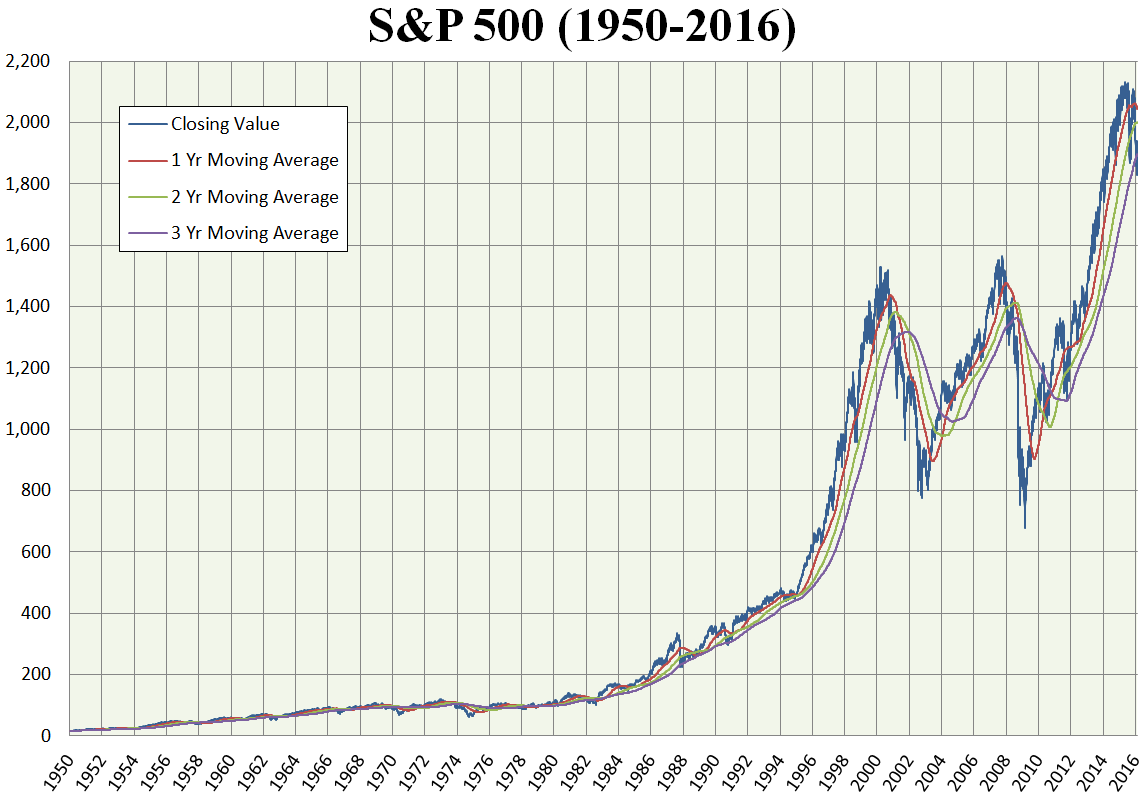

Check out this graph that’s tattooed on my back I love it so much.

I have to update the tattoo every year. It gets painful.

This is how the S&P 500 has performed since 1950. Notice how even in the down years, the market bounces back.

Because of this, your risk is mitigated over a long period of time. You can pick nearly any 15-year window on this chart and end up ahead. But if you invest for short term, you will need to invest more conservatively (if you pick a 3-year window, your odds get worse).

“What’s my risk tolerance?”

So now that you know what your timeline looks like, ask yourself: Am I actually comfortable with risk?

If you are comfortable with it, how much risk are you willing to take?

If the market took a 20% nosedive tomorrow, would you be okay with that? Or would you be scrambling to cut your losses?

I used to teach a class on personal finance and during one of the sessions, I drew a picture of a rapidly falling fund. Then I asked, “What should I do?”

Inevitably, a good chunk of the class did their best Wall Street stockbroker impression and yelled, “Sell! Sell! Sell!”

So now I want to ask: What would YOU do?

- Sell immediately and cut your losses

or - Hold onto the fund

Well, knowing how the S&P 500 has trended for over half a century now, you should know the answer: If you’re young, hold onto the fund.

That’s why, if you’re in your twenties, you should be comfortable investing more in riskier investments (e.g., stocks) rather than safe ones (e.g., bonds).

If you’re older, your risk tolerance is likely going to be lower. As such, you’ll want to reconfigure your asset allocation so you’re investing in safer investments such as bonds as opposed to riskier ones like stocks.

“What are my goals?”

Your investment choices depend not only on your timeline and risk tolerance, but also your goals.

Are you saving up for a car that you want in two years?

Or are you planning on paying for a wedding in five?

Maybe you want to just make sure that you have a nice little nest egg for retirement 30 years from now.

No matter what your goals, recognizing what they are will help you determine how to approach your strategic asset allocation because they’ll help you answer the above two questions.

Why don’t people rebalance their portfolio?

So now you know that rebalancing your allocations to stay in line with your goals is important…so why is it that I still find older people with 90% stocks AND college grads with 50% bonds?

The main reason people don’t maintain a reasonable asset allocation is because of human psychology. As humans, we fall victim to simple psychological biases.

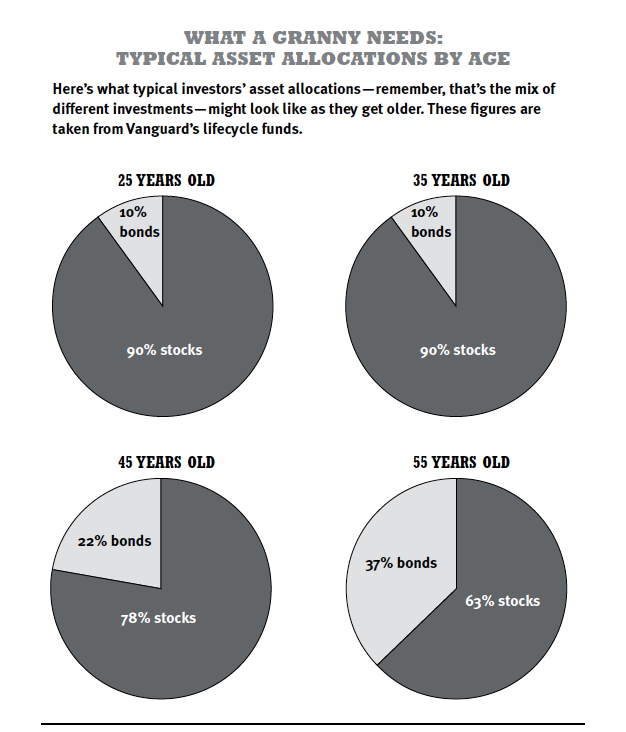

Even when you have charts like this with great suggestions:

…people will still fail to rebalance their assets over time.

After all, why would you want to take your money out of one asset class that performed well over the year and put it into one that might have disappointed you?

The trick to addressing these psychological biases: Automation. More specifically through a target-date fund (aka lifecycle fund).

Lifecycle funds: An easy way to invest

This is one of my favorite investments of all time, because they are:

- Automated

- Easy enough for anyone to get started

- Safe ways to earn money through investments

These funds automatically diversify your investments for you based on how old you are. So instead of actively rebalancing your stocks every year, this fund automatically does it for you.

As you get older and retire, for example, your lifecycle fund will automatically change to a more conservative asset allocation so you don’t have to worry about any drops in your retirement account.

Lifecycle funds can also be described as “funds within funds” (Yo dawg…) or collections made up of other funds.

For example, a single lifecycle fund might include large-cap, mid-cap, and international funds (all of which include their own stock selection). This sounds complicated but it actually makes everything very easy for you as you only have to own one lifecycle fund and the rest is taken care of for you.

That said, lifecycle funds aren’t for everyone. After all, they only factor in one variable: age. Everyone has different investment goals, and these funds aren’t tailored to your individual situation.

However, they are designed for people who don’t want to mess around with rebalancing their portfolio at all. For you, the ease of use that comes with lifecycle funds might outweigh the loss of returns.

One thing you should note: Most lifecycle funds require between $1,000 and $3,000 to buy. If you don’t have that kind of money, don’t worry. Check out my article on how to make money fast to help you get there.

For a more in-depth explanation, check out my video all about lifecycle funds, which was clearly filmed many lifecycles ago.

Master your personal finances

Though lifecycle funds are an easy way to approach your investments, you might want to be more hands-on when it comes to your asset allocation — and that’s okay! It’s YOUR personal finances, which means these are your decisions to make.

No matter what you choose to do, you want to make sure that you have a solid foundation in place for your finances, which is why I have something for you: The Ultimate Guide to Personal Finances.

In it, you’ll learn how to:

- Master your 401k: Take advantage of free money offered to you by your company…and get rich while doing it.

- Manage Roth IRAs: Start saving for retirement in a worthwhile long-term investment account.

- Automate your expenses: Take advantage of the wonderful magic of automation and make investing pain-free.

Enter your info below and get on your way to living a Rich Life today.

All about strategic asset allocation is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment