Real quick: How much does the average wedding in the United States cost?

If you guessed anything other than $35,329, you’d be wrong.

How is it possible that someone can spend this much money on a single day? And how is it possible that everyone who thinks their wedding “doesn’t need to be that fancy” eventually spends more than they planned?

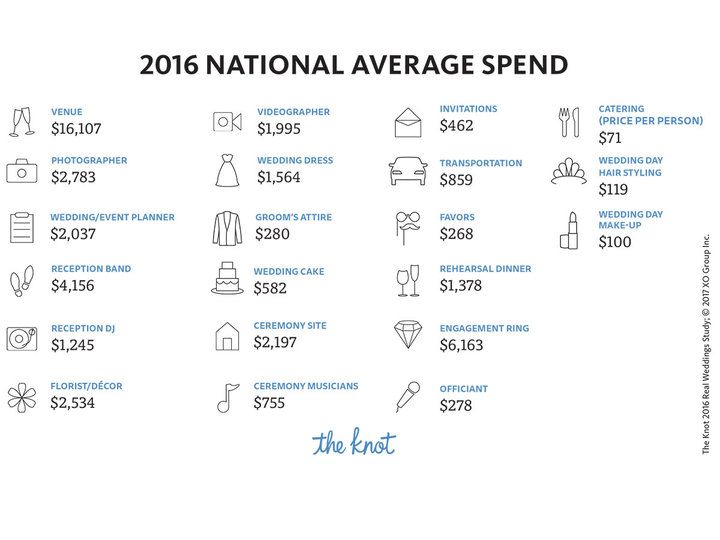

To answer that question, you have to understand that every little part of the wedding — from the venue right down to who you want videotaping everything — is going to cost money. And these costs add up quickly. The Knot recently published their list of average costs, so let’s take a look at the average price spent on (most) everything at a wedding.

A few quick takeaways:

- The venue is the most expensive part of the wedding. And if you think you’re going to be able to save on it by holding your wedding at your house, you’re wrong — and I’ll explain why in a bit.

- Your final price is going to fluctuate depending on how many guests you have, but on average there are about 120 guests at a wedding. That means catering for everyone can be in the neighborhood of $8,520.

- LOL at how much more my fiancee’s dress is going to cost than my tux.

These prices might actually INCREASE depending on where you live. For example, the average wedding in New York City can cost over $78,000. When compared to Utah, where you’ll most likely pay in the neighborhood of $20,000, NYC can seem astronomical.

So how do we solve this $35,329 question?

How to save for your dream wedding (with advice from a wedding planner)

To get a better idea of how couples can save for their dream wedding, we talked to wedding planner Sarah Glick. She co-owns Brilliant Event Planning along with Chelsea LaFollette. For years, the two have been planning weddings all around the world — so they’ve personally handled their fair share of expensive weddings.

“The budgets for our clients really vary, depending on head count and location, but we have planned weddings for clients with budgets exceeding $1 million,” Sarah says.

Whether you want to save for a wedding of $35,329 or $1 million, all you need to do is follow a system of three steps:

- Set a realistic budget

- Prioritize the important things

- Use sub-savings accounts to help you save

Step 1: Set a realistic budget

Even though you’re on a personal finance site like IWT, you’re still human. That means that your wedding will most likely be much pricier than you originally thought. The best way to not fall into debt when the day you sign a check to vendors arrives is to anticipate and plan for it.

“Set a budget,” Sarah says. “People often think they can just handle each contract with a vendor as it comes up and deal with the costs on a case-by-case basis. However, that often results in the client spending way more than they wanted to spend and more than they would have spent had they considered the overall big picture from the beginning of the planning process.”

So sit down and make a realistic budget of how much your wedding might cost you. The back-of-a-napkin formula for it is simple too. Simply take into account:

- The average age at marriage, which is about 31 for men and 29 for women.

- The average wedding cost, which is about $35,000.

If you’re 21, you should each plan to save around $3,500 a year or $292 a month.

And if you think that’s unreasonable, I have two things to tell you:

- Even if you can’t save that much now, any amount you CAN save will add up down the road. Can you afford $50/month? If so, that’s $50 better than you were doing yesterday.

- If you work towards earning more money, you’ll be able to eventually save this much. Keep reading and I’ll give you the exact resources you can use to get there.

Of course, this will change depending on how old you are and how much you want to spend on your wedding. Here’s a great wedding cost calculator you can use to give you a rough estimate of how much you should save based on what you want for your big day.

Step 2: Prioritize the important things

If your budget seems a little bit intimidating and you want to find areas to save, don’t worry. You can always prioritize aspects of your wedding to help you cut back.

“This depends on what the couple’s priorities are. Everyone is a little bit different,” Sarah explains. “Couples can save by choosing one or two areas to splurge on and then being cost conscious for everything else.”

It’s human nature to want the best for our wedding day, and we need to be realistic about that. However, you also need to be realistic about the fact that you can’t always have the best of everything. That’s where prioritization comes in.

From Sarah:

“For example, even though a DJ is cheaper than a band, live music is sometimes a must for people, regardless of budget. If you decide that the live band is a must-have, then you might want to skip custom invitations and order from an online vendor to save on stationary.

Couples can also save by going with a venue that has tables, chairs, linens, etc. already included. The contrast to this is a raw space where you would need to rent everything (which corresponds to a significantly higher rental spend).”

Remember how I mentioned that your wedding’s location can affect how expensive it is? You can leverage this fact and cut back on your wedding expenses by choosing a more budget-friendly location.

“A wedding in Mississippi, for example, will cost much less than a wedding in New York City, even if the head count stays the same,” Sarah says.

Once you know what your priorities are, revisit your projected wedding budget and reconsider some areas where you can cut back. If you have the costs on paper, you’ll know exactly which trade-offs you can make to keep within your budget. If you haven’t decided on what you want to spend though, it’ll look like there are no trade-offs necessary.

THAT’S how people get into debt for their wedding.

But I’m not going to let that happen to you. That’s why I’m going to show you how to set up a sub-savings account where you can put money away for your wedding automatically each month.

Step 3: Use sub-saving accounts to help you save

Let’s assume you’re 25 years old and plan to spend $40,000 on your wedding. Let’s say you also plan on getting married by the time you’re 30.

If you want to pay for the whole wedding yourself (a totally achievable goal), you’ll have to save about $8,000 a year or $666 a month for the wedding (let’s not read too much into that last number).

A perfect way to put away that evil amount each month is through a sub-savings account. This is a savings account you create in addition to your regular savings. Often times, you can even name them too!

You can leverage your sub-savings account to:

- Put money away towards specific savings goals

- Save cash when you automate your finances

The beauty about them is that they allow you to see exactly how much you’ve saved because the account is tailored for that specific goal. This does wonders for you psychologically.

When I first discovered sub-savings accounts, I created one and named it “Down Payment” for a down payment on a house. I was regularly transferring money into it based on my savings goals using my automated finances.

As the months passed, the amount in that account grew bigger and bigger, and I felt really proud of my accomplishment.

During this time, one of my friends was just blindly putting away money in an account he had mentally earmarked for vague goals.

Though we might have had the same amount saved away, the difference between us psychologically was staggering. Where he felt despair about trying to save money, I was motivated.

For me, I wasn’t working towards $20,000 for a down payment. I was working on saving $333 a month over five years — a perfectly achievable goal, especially after I tracked my progress.

So go to your bank’s website and open up a sub-savings account and name it “Wedding fund.” Once you’ve done that, you can now automate your finances so you’re putting money into it each month automatically.

Check out my video below to learn exactly how to set it up today.

Two big things couples get wrong about their wedding

There are a few things that couples do that they think are saving them money but are actually costing them more in the long run. Let’s go into them now so you can avoid them when planning for your wedding.

According to Sarah, those two misconceptions are:

“I’m just going to put a tent up at my home — it will be cheaper.”

The venue is typically the biggest expense for any wedding day. So if just use your home instead, shouldn’t that offset the cost?

According to Sarah: Nope!

“A lot of clients come to us and say they want to put a tent on private property to save on venue costs,” Sarah says. “However, if the property is a private home, I can almost promise it’ll be more expensive than a more typical wedding venue.”

The reason why is the same reason wedding venues are so expensive in the first place. Vox actually did an investigation of why wedding venues are so expensive and it’s due to the fact that weddings need more tender loving care than normal events.

Think about it. This is one of the only events that people expect to go perfectly. If it doesn’t, you end up with situations where people act like they’re on an episode of Bridezilla.

Also, your home is probably not suited for a wedding anyway.

“Your home is not created for events,” Sarah says. “You need to bring everything in including bathrooms for your guests, heating/cooling if the weather isn’t perfect, functional lighting, access to water and power (which means we need to run those lines), a second tent for catering, all of the tables, chairs, china, glassware, and flatware…and more!”

You also have to worry about paying for delivery and moving for all of the above, she adds.

So having the wedding in your backyard won’t help. Maybe if you had a destination wedding instead…

“Destination weddings are cheaper — fewer people will show up!”

Some people think that because you’re flying out for your wedding, you’ll be able to save money because, surely, fewer guests will want to show up…right?

“Truth is, [destination weddings] often cost the same as a local one,” Sarah says. “It used to be that if a wedding required travel, people would have a hard time getting there or affording the travel. And so they wouldn’t be able to come. However, nowadays, it is SO easy to travel. Flights can be found inexpensively and companies like Airbnb exist to make staying in a foreign place simple and affordable.”

So even if you have that awesome travel rewards credit card and can fly anywhere in the world for free, it doesn’t mean that your wedding will be cheaper.

“We’ve found that our head counts for destination weddings often do not differ very much from our local weddings,” she says.

Earn more to afford the wedding of your dreams

Despite what society tells you, there’s no right or wrong price for your wedding. You might have a wedding in the high six figures, or you might just have a wedding that ends up costing a couple thousand. Both are perfectly fine. What matters most is that you’re realistic about what you’re going to spend so you know what to save.

If you want a wedding that might cost a little bit more than you’re able to save for right now though, there is a solution: Earn more money.

You can only save so much money at the end of the day. However, there’s no limit to how much you can earn.

That’s why my team and I have worked hard to create a guide to help you invest in yourself today: The Ultimate Guide to Making Money.

In it, I’ve included my best strategies to:

- Create multiple income streams so you always have a consistent source of revenue.

- Start your own side hustle so you’re earning money for any financial goal (like a wedding).

- Increase your income by thousands of dollars a year through earning raises and freelancing.

Download a FREE copy of the Ultimate Guide today by entering your name and email below — and start earning money for your big day today.

Why are weddings so expensive? is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment