I got a great question from a reader named Sherene a while back asking about which was better: Roth IRAs vs CDs? She wrote:

“I am a recent college graduate and I want to put the little money I have saved (approx $3,000) into something that will give me good returns over the years. Would you suggest I get CDs or a Roth IRA?”

My answer: They’re not mutually exclusive. Roth IRAs are a type of investment account and CDs are simply a type of investment. You can have both!

A quick overview of each:

- CD: These are a type of investment known as time deposits. This means you essentially loan money to a bank for a set period of time and when that time is done, they’ll give you your money back plus interest. This makes them very low risk.

- Roth IRA: This is an investment account with significant tax advantages. It allows you to invest in funds of your choosing and accumulate money for retirement age.

Whether or not you choose to invest in CDs all depends on what your goals are. Let’s take a look at the two investments and how you can get started with them should you choose.

Roth IRA: An account EVERYONE should have

Along with a 401k, the Roth IRA is one of the best investments you can make as a young person.

A Roth IRA puts your after-tax money to work for you. That means you can put already taxed income into bonds, index funds, or whatever else into the account, allow it to accrue compounded interest over time, and eventually withdraw it when you retire…

…and pay no taxes when you withdraw it.

What does this mean for Sherene? That means her greatest advantage is time. If the market dips slightly, Sherene has nothing to worry about because she knows it will, in the greatest likelihood, bounce back.

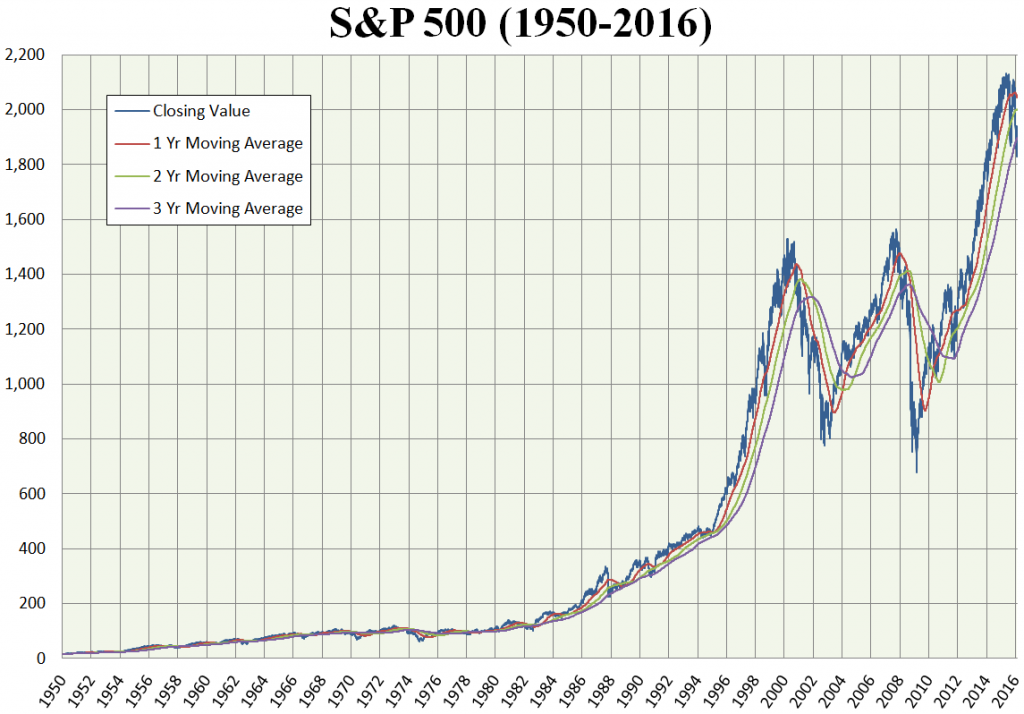

The S&P 500 since 1950.

And over the years, this makes the Roth IRA account with an index fund a fantastic investment.

How to open a Roth IRA account

If Sherene (or you) wants to open up a Roth IRA, she’ll need to open up a brokerage account. There are plenty of great ones out there with fantastic customer service and fiduciaries ready to guide and answer any questions you might have about your investments.

Other factors you want to consider when looking at brokers:

- Minimum investment fees. Some brokers require you to invest a minimum amount in order to open and hold an account. This can be a deal breaker for many.

- Investment options. All brokers differ in what they’ll offer in the way of investments. Some have funds that perform better than others.

- Transaction fees. A few brokers charge you a transaction fee in order to put money in an investment.

A few brokers I suggest: Charles Schwab, Vanguard, and E*TRADE.

Not only do those three provide a great customer support line, but they also have small or no minimum investment fees and are known for their great stock options.

How much can I invest?

Currently, there’s a yearly maximum investment of $5,500 to a Roth. However, this amount changes often so be sure to check out the IRS contribution limits page to keep updated.

Once your account is set up, your money will just be sitting there. You need to do things then:

- First, set up an automatic payment plan (which we’ll explain how to do later) so you’re automatically depositing money into your Roth account.

- Second, decide where to invest the money in your Roth account; technically you can invest in stocks, index funds, mutual funds, whatever. But I suggest investing your money in a low-cost, diversified portfolio that includes index funds such as the S&P 500. The S&P 500 averages a return of 10% and is managed with barely any fees.

For more read my introductory articles on stocks and bonds to gain a better understanding of your options. I also created a two minute video that’ll show you exactly how to choose a Roth IRA. Check it out below.

When can I take my money out?

Like your 401k, you’re expected to treat this as a long-term investment vehicle. You are penalized if you withdraw your earnings before you’re 59 ½ years old.

You can, however, withdraw your principal, or the amount you actually invested from your pocket, at any time, penalty-free (most people don’t know this).

There are also exceptions for down payments on a home, funding education for you/partner/children/grandchildren, and some other emergency reasons.

But it’s still a fantastic investment to make — especially when you do it early. After all, the sooner you can invest, the more money your investment will accrue.

To quickly recap:

- Roth IRA = Investment account

- CD = A thing you can invest in

But should you put money in CDs at all?

CDs: What the heck are they?

A CD, or certificate of deposit, is a low-risk financial investment offered by banks. If you invest in a CD, you loan money to a bank for a fixed time known as a term length (typically anywhere from three months to five years). In this time, you can’t withdraw your investment without being penalized. However, you are accruing money at a fixed rate.

Your interest rate on a CD varies depending on the length you agree to keep your money in the bank (the longer you keep it there, the more money you earn). But you are all but assured that money when the term length is up.

Another reason why they’re so risk-free: CDs are typically insured by the FDIC up to $250,000. That means if you put $100,000 into a CD and accrued $5,000 in interest, your $105,000 would be insured if your bank fails (which it won’t).

That makes CDs an incredibly safe investment.

Who should invest in them?

Older people typically invest in CDs due to their aversion to risk. However, there are several factors to consider if you’re wondering if you should invest in a CD:

- Length of investment. Can you part with the money during the full term length?

- How aggressive you want to be. Do you have more wiggle room to invest in riskier funds or do you just want to play it safe?

- Inflation. As of writing this, the inflation rate sits at 2.2%. That percentage is also on the high end for most annual percentage yields for CDs, which are typically anywhere between 1% to 2% for a 5-year bond. This means you could actually lose money when you factor in inflation with CDs.

CDs are a safe investment. If you value security and peace of mind over taking a few more risks for potentially higher gains, you might just want to put your money to work in a CD. Also, bonds like CDs can be used for short-term goals such as buying a house or putting more money into your emergency fund.

Make the smartest investment today

There’s no one-size-fits-all solution.

Some people are going to have a diversified portfolio of index funds and never touch it. Others might want to put more money into the market and more actively handle their funds. There’s no right or wrong answer to how you do things. The choice is up to you.

But, it can be confusing if you’re new to this world and have no idea how to get started.

That’s why I’m excited to offer you something for free. I have an offer: My Ultimate Guide to Personal Finance.

In it, you’ll learn how to:

- Master your 401k: Take advantage of free money offered to you by your company…and get rich while doing it.

- Manage Roth IRAs: Start saving for retirement in a worthwhile long-term investment account.

- Automate your expenses: Take advantage of the wonderful magic of automation and make investing pain-free.

With this guide, you’ll be well on your way to living a Rich Life. And you don’t need any fancy get rich quick schemes or snake oil or other BS “solutions”. All you need is determination and the right systems put in place to help you get the most out of your financial situation and not have to worry about living “frugally” (aka sacrificing the things you love).

Enter your info below and receive my FREE bonus video on how to reduce your debt today.

Roth IRA vs CD: Which investment is best for you? is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment